Tracking Error

Tracking error is the difference between the return an investor receives and that of the benchmark they are attempting to replicate.

Why is this important?

In a volatile market your conviction to mirroring the benchmark allocation to growth vs defensive assets for your particular risk profile can be tested. Importantly if you take an active position one way or the other away from the neutral allocation and get the call wrong you can be heavily penalised form a performance perspective.

In many cases it is therefore not an all or nothing approach but rather thinking about the portfolio position from an under or overweight position.

Let’s apply that logic to the current share market correction and the possible portfolio positions you could have taken heading into 2020.

Option 1

If you had an underweight or neutral position to the share market heading into 2020 then you would have lost less when the share market crashed by over 30% in March 2020. If you simply held the same portfolio since then your performance for the financial year is likely to be flat, i.e. you would not have made any money or lost any money.

Option 2

If you had an overweight position to the share market heading into 2020 then you would have lost more when the share market crashed by over 30% in March 2020. If you simply held the same portfolio since then your performance for the financial year is likely to be a negative one.

What would have happened if you then tried to make changes since the share market crash?

Option 3

If you had an underweight position to the share market heading into 2020 and increased risk after the share market crashed by over 30% in March 2020 you would have made money from the market rebound, i.e. your performance for the financial year will likely be a small positive one.

Option 4

If you had an overweight, neutral or underweight position to the share market heading into 2020 and you decreased risk after the share market crashed by over 30% in March 2020 you would have lost money as the market rebounded, i.e. your performance for the financial year will likely be a negative one.

In summary our investment strategy aligned with option 3 albeit with hindsight we would added risk, i.e. increased the allocation to growth assets, a little earlier than when we did. Importantly, we make decisions based on the information available at the time.

How much economic damage might markets have already priced in?

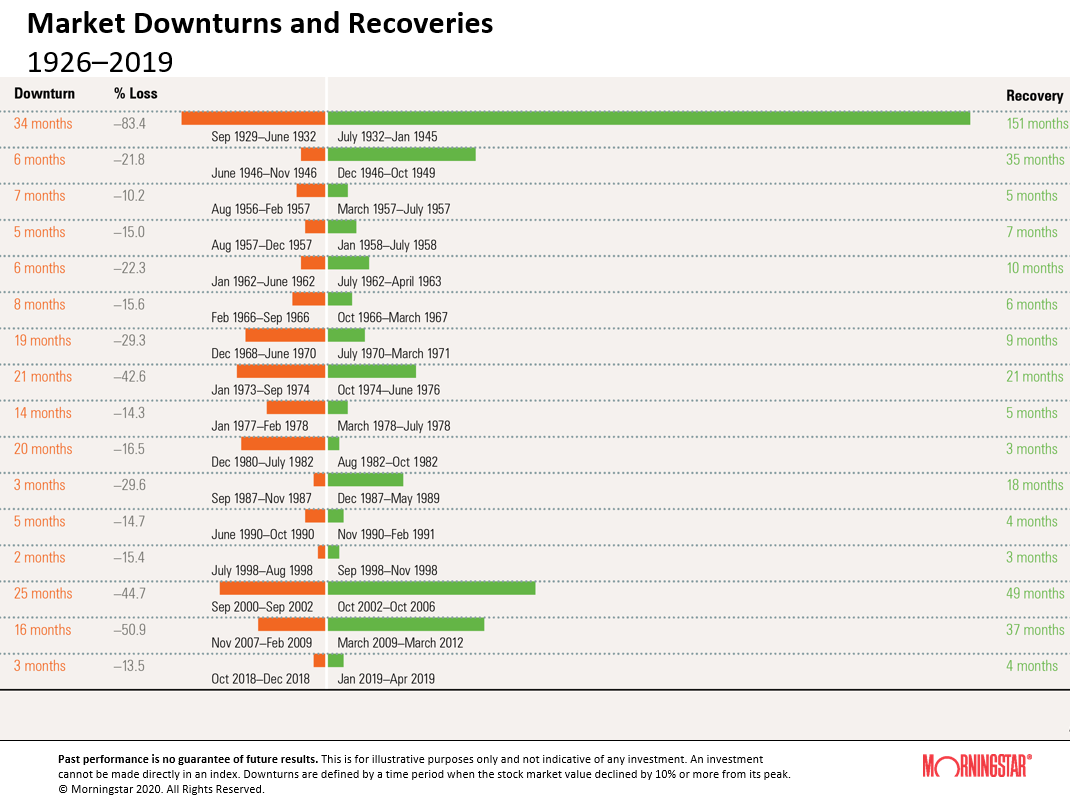

Markets should be prepared for continued volatility in the short-term. In a standard recession share markets typically fall approximately 20-30%. Other recessions, such as the dot-com bust of the early 2000s and the GFC, saw the share market drop roughly 50% from peak to bottom.

Markets appear to have already priced in a standard recession, but things are now looking much worse.

The chart below would indicate that 4 months since the share market correction there is still some way to go and this volatility could last for another 12 months.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.