Financial Year Performance numbers

While the Financial Year performance numbers ending 30 June 2020 should be available in the next week, we wanted to give you an indication of what to expect when your statements are sent to you in the coming months.

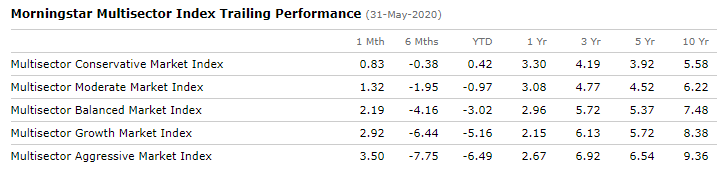

While the numbers below illustrate performance for various risk profiles ending May 2020 you can expect a slight reduction as despite a late rally overall June number were weaker. We estimate you can reduce the yearly numbers in the following table by circa 1% to 1.5% to attain this Financial years performance.

In summary, you should expect a marginally positive return for the financial year, which broadly is in line with cash rates.

Last week, a record increase in virus cases in the US contrasted with a record increase in monthly job numbers. Better than expected manufacturing data in the US and China helped the recovery narrative. The US share market price recovery has continued to outpace other developed markets. US shares recovered 4% last week to be just 3.1% from the start of the year. This contrasts with the UK and Europe, that are 18.4% and 12.1% lower respectively. Interestingly China’s share market is 7.9% higher in 2020.

Just four sectors, representing a quarter of the ASX 200, provided positive returns during the 2019/20 financial year.

While markets performed well during the first half of the financial year, the impact of the COVID-19 pandemic caused the ASX 200 to lose 8% during the financial year.

Healthcare was the best-performing sector with returns of 26.4% followed by technology at 16.6% and consumer staples at 13%. Consumer discretionary also managed to report a smaller positive return of 3.2%.

The AUD appreciated and is now sitting close to USD0.70. The AUD has recovered more than 25% from its trough in late-March where it touched on 0.55c.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.