Share market - valuation – is it cheap or expensive?

Global share markets have largely recovered from their lows in March 2020. The US share market has made up most of their losses from peak to trough led by tech stocks, while the ASX lags circa 15% from peak to trough.

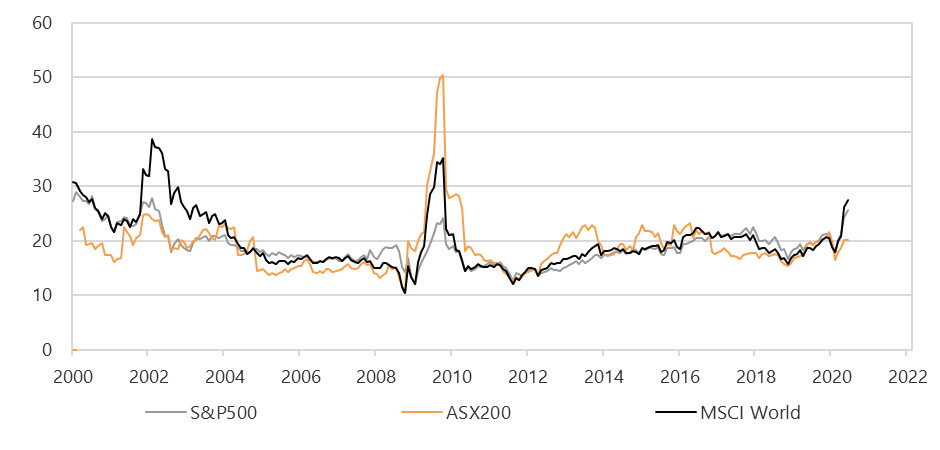

Company earnings have collapsed as lock downs persisted, leading to a surge in the price-earnings ratio. With such high P/E ratios this leads us to believe the share market is overvalued right now and why we continue to be cautious in allocating further to growth assets.

You can see by the chart below the ASX P/E ratio is currently trading at circa 20x and the average is normally circa 13 - 14x.

Chart: PE ratios have surged as prices have rallied in Q2.

We think the surge in prices reflects:

- Central banks globally have cut interest rates to extreme lows, if not negative levels. Asset purchase programs have added liquidity in financial markets.

- Uncertainty about real economic growth. Investors would prefer to take the certainty of a negative real return from US and European Government bonds than invest in the real economy with uncertain returns.

- Corporate buybacks. The impact of low real yields and an uncertain return from reinvesting cash leaves issuing cheap debt and buying back equity an attractive option for corporate treasurers.

- Economic recovery. The gradual global economy is recovery is progressing. Economies are exiting lockdown however with a second or third wave this could change quickly.

- Earnings have surprised on the upside in the recent US earnings reporting season. We think that will coincide with PE ratio compression, bringing equity valuations back towards historic norms even as prices continue to rally.

Be wary of gold.

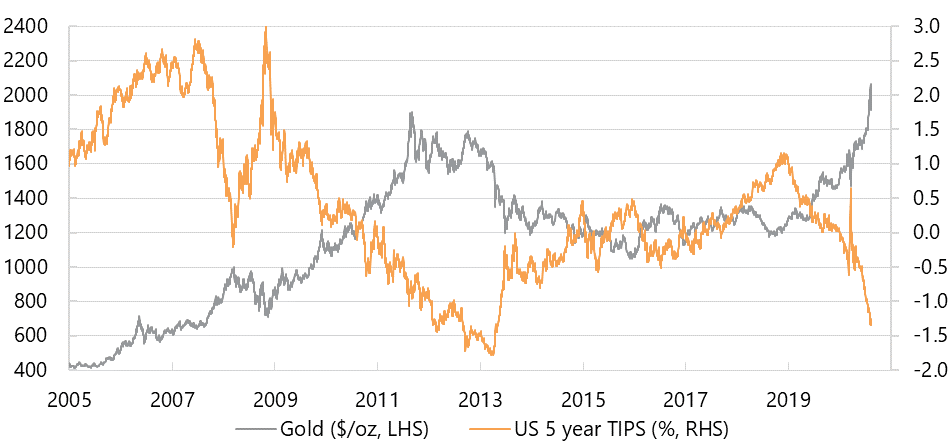

The gold price reached a record high price in August. In our view, gold falls into the speculative asset class description as it has share market like volatility, a positive correlation to Global Equities (see chart below so does not diversify portfolio risk), it does not have a stream of income attached to it and it is challenging to derive fair value.

Chart: Gold has moved higher as real yields have pushed lower.

The precious metal price has been supported by:

- A weaker US dollar. Gold is priced in US dollars and the weaker currency will support gold prices.

- Low real yields. Negative real yields make gold’s zero income stream relatively more attractive.

- Rising inflation expectations. Inflation expectations have increased due to the economic recovery and the US Federal Reserve’s aggressive monetary policy.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.