Well, that was historic. The fastest 30% drawdown in the history of global equities in the first quarter of 2020 followed by the largest 50-day advance in market history in the second quarter. From a contrarian perspective, this is now very troubling. Whenever a lot of people are bullish, it’s a sign that most of the good news is already priced in.

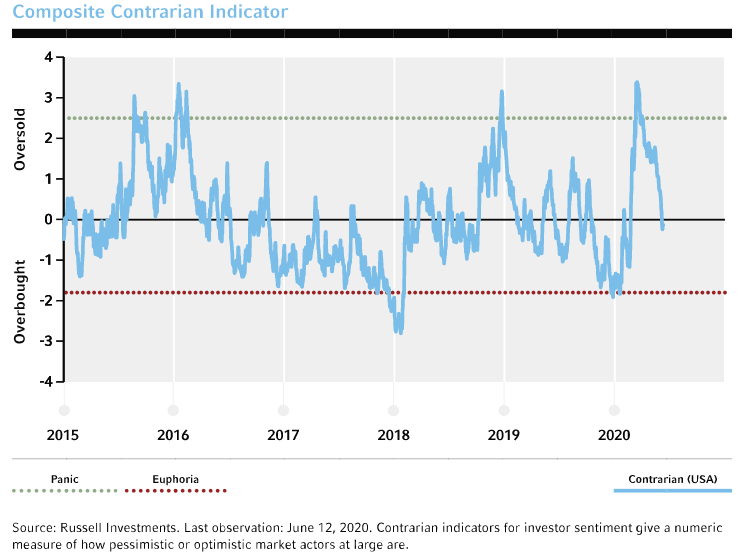

The market rebound means that value is no longer compelling for global equities. On the other hand, the cycle outlook has improved as fiscal and monetary stimulus announcements continue and economies start to emerge from lock down. The Russell Investment composite contrarian indicator (below) is providing a neutral signal. This means that the support from oversold conditions is waning and markets are at greater risk of pulling back on negative news.

Neutral value, neutral sentiment and a supportive cycle give us a more balanced view on the investment outlook. Looking near-term, markets are vulnerable to negative news after a 40% rebound and with sentiment on the verge of triggering their overbought signal.

Here are five likely longer-term impacts of the pandemic.

1) Low interest rates for longer.The global economy has taken a huge hit from the pandemic and interest rates are zero or lower at all the major central banks. There is a lot of economic spare capacity which will keep inflation low for the next couple of years at least. This means central banks will keep rates low, which will keep bond yields low. Furthermore, after experiencing zero rates, central banks are likely to keep rates low once inflation rises. They will be reluctant to tighten too quickly.

2) Less globalisation.Globalisation was already in reverse before COVID-19. The 2008 financial crisis undermined the trust of western voters in the free market capitalist model. The backlash continued with Brexit, the rise of Trump and the U.S./China trade war. The virus is accelerating the anti-globalisation trend. Global supply chains are being unwound and the pandemic has created fears about food security and pressure for domestic production of medical supplies.

3) More government debt and a bigger share of government in the economy.The lockdowns are leading to the largest rise in government debt levels since World War II and higher levels of government support for industries. Eventually, the political debate will turn to how to pay for the lockdown support measures and how to address the inequalities that have been worsened by the pandemic. Well-paid white-collar workers have been able to isolate at home while lower paid workers have been laid off or had to work in less-safe conditions.

4) Higher inflation, eventually. Inflation shouldn’t be a problem for the next couple of years due to economic spare capacity caused by the recession. Longer-term, inflation could rise by more than expected. Globalisation was deflationary and its reversal will be inflationary. On the supply side, it would be inflationary from higher input costs, less cheap foreign labour and rising tariffs and protectionism. On the demand side, central banks likely would take a lax approach to rising inflation and governments would see higher inflation as a way of reducing debt burdens.

5) Pressure on profit margins.Slower trend economic growth, less efficient capital allocation, just-in-case instead of just-in-time inventory management, higher taxes and higher labour costs will place profit margins under pressure. One potential offset is that the increased use of technology encouraged by the lockdowns will generate cost savings and productivity improvements.

The super rich just raised cash to a record level to hedge against a period of unknown. Tiger 21, a group of 800+ investors averaging more then $100 million in assets each says they are sitting on a record cash pile representing 19% of their holdings. That's a spike from the 12% level over the last few quarters.

“Members are deeply concerned about the gap between Wall Street and Main Street and are therefore acting defensively to keep cash balances high,” Tiger 21 Chairman Michael Sonnenfeldt said. Part of the fear that’s brewing among the deep-pocketed set is that the clouds of uncertainty — coronavirus, the November election, civil unrest in some U.S. states, geopolitical tensions, etc. — will continue to hang over this market for a while.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.