The Reserve Bank has publicly committed at its February 2021 meeting to record low interest rates until 2024 at the earliest and extended its Government bond buying program to another $100 billion despite upgrading its employment and inflation forecasts.

“The board will not increase the cash rate until actual inflation is sustainably within the 2% to 3% target range. The board does not expect these conditions to be met until 2024 at the earliest.”

The positive outlook and further commitment of cheap money helped the S&P/ASX 200 Index rise

The central bank maintained its cash rate target at 0.10% and lowered its unemployment forecast to hit 6% by the end of this year, down from the 6.5% it had forecast less than three months ago. Inflation and GDP forecasts have also been slightly upgraded.

RBA governor Philip Lowe said the economic recovery was faster than expected and that GDP was now expected to return to its pre-pandemic level by the middle of this year. “The economic recovery is well under way and has been stronger than was earlier expected,” Dr Lowe said in a statement.

However, he said the outlook would depend on the success of the vaccine rollout and the maintenance of both fiscal and monetary stimulus and that meant keeping record low rates pinned down for at least another three years.

The RBA also noted specifically that “the exchange rate has appreciated and is in the upper end of the range of recent years”.

To read the full RBA meeting statement please click here.

So, what does low interest rates mean for Investors?

While low interest rates persist, return expectations need to be lowered. This will have a major impact on wealth accumulation and retirement planning strategies. You will either have less in retirement savings or need to be more careful how much you spend when you cease working and drawing on your nest egg.

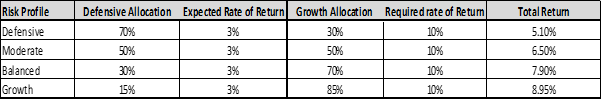

Below is a table of expected total returns for various risk profiles, i.e., mix of growth vs defensive assets. If we assume cash and fixed interest investments deliver a rate of return of 3% p.a. (which would be at the upper end of the return range) and if we perhaps optimistically assume a 10% return from the share market the range of returns is between 5.10% and 8.95% p.a.

While the easiest solution would be to simply increase the allocation to the share market to chase a higher return, it also means dialing up risk in the portfolio.

Over the past 2 weeks with the momentum of the “America Rescue Plan” stimulus we have been investing in stages and reducing the underweight position to growth assets.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.