RBA Financial Stability Review

The Reserve Bank's assessment of the health of the financial system is undertaken every six months. And the focus of the latest report is the housing market.

Please click here to read the full report.

At a Glance

1) Financial systems in Australia and internationally remain resilient despite some setbacks

Financial systems in Australia and internationally have been resilient to the effects of the COVID-19 pandemic. Banks have cushioned the economic impact of the pandemic and have supported the recovery through loan repayment deferrals and new lending.

2) There is a risk of excessive borrowing due to low interest rates and rising house prices

Low interest rates have contributed to high prices for financial assets and housing. There has been some increased risk-taking and higher borrowing.

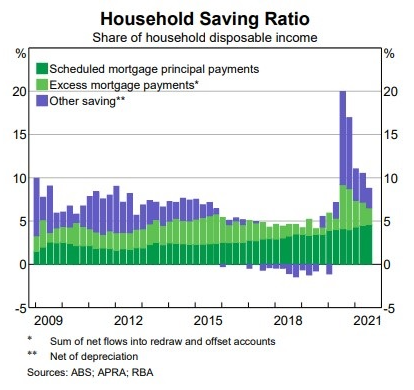

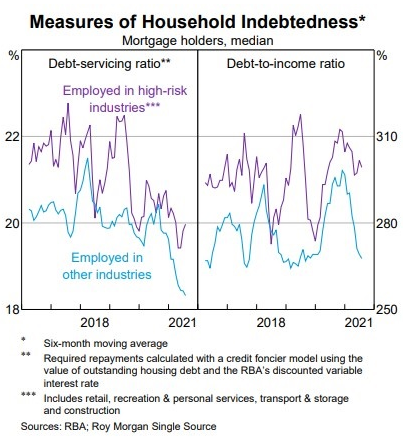

3) Most borrowers' income has recovered, but others may struggle with loan repayments

Most borrowers' income has recovered from large falls resulting from the pandemic. But income remains lower for some in heavily impacted industries and particularly in some emerging market economies.

4) Cyber-attacks remain a growing risk for financial stability

The number and severity of cyber-attacks on financial institutions continues to increase. In Australia and internationally, financial institutions and regulators are focusing on strengthening the resilience of individual institutions and the financial system to a substantial cyber-attack.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.

Copyright © 2021 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018