Back to back 0.50% interest rate increases

Inflation (cost of living pressures) and rising interest rates continue to dominate headlines and cause continued share market volatility.

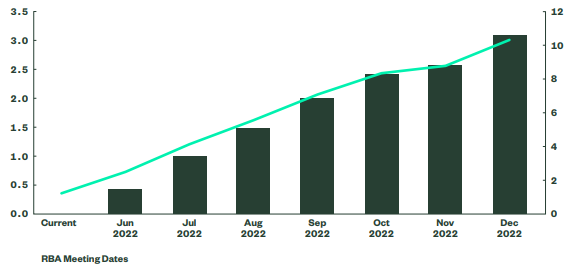

The Reserve Bank of Australia (RBA) had been among the more dovish developed market central banks until as recently as April. They are now taking decisive action to curb inflation and cash rate futures markets are pricing in an even more steeper hiking path than before. Markets are factoring in that the RBA will raise to 3% by year’s end (see chart below). That’s well ahead of a central bank’s cash rate forecasts and causing much concern.

How does higher interest rates affect the share market?

Quite simply higher interest rates lead to a higher cost of capital, i.e., borrowing costs, which ultimately translates into lower profit. Lower profit means valuations need to be re calibrated and that’s what’s driving volatility. The share market is trying to anticipate the pace of the increases and how high interest rates will ultimately go.

Investors are loss averse

Ultimately all investors would like a high return with a low degree of risk. Studies illustrate that investors do not think about loss and gain on the same playing field. In fact, an investor has to achieve close to a threefold gain to feel the same emotion as losing just $1 of capital.

So how do we approach portfolio management when the ASX 200 has fallen nearly 9% this year so far, the US share market has fallen over 14% this year so far and “Fixed Duration” defensive assets have also delivered a circa -7% return over the last 12 months.

- Have a sensible starting position to the share market in the first place. Diversification is essential.

- Focus on quality companies that are “price makers” vs “price taker’s “. While not immune from broader share price volatility they won’t fall as far and rebound faster, i.e., a flight to quality occurs. Investing is not speculating.

- Focus on dividends and franking credits to deliver a base line income return of circa 4-5% plus franking credits.

- Rotate fixed income investments away from “Fixed Duration” bonds to “Floating Rate Credit” and now start to include term deposits in the portfolio. Understanding risk is crucial.

- Build up cash reserves via super contributions or income distributions from underlying investments. This naturally reduces overall exposure to the share market.

- For pension clients hold enough cash to fund 12 – 18 months pension payments so we aren’t forced to sell assets at discounted prices.

- prepared to make smart changes where necessary and don’t panic as a result of the volatility. Discipline is paramount.

- Reduce costs and taxes wherever possible.

Please refer to the Weekly Strategy Note on the 14/02/2022 (click here) where we outlined an expected increase in share market volatility as interest rates normalise.

This is a significant structural change, and while it may feel uncomfortable at times, we need to remain disciplined to the medium-term strategy, i.e., don’t make hasty and irrational decisions.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.

Copyright © 2022 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018