Equity markets were in freefall last week representing the worst week in nearly 2 years, i.e., Covid crash in March 2020. Last week the Fed raised rates by 0.75% after the shock inflation rise the week before. In Australia, the RBA Governor was hawkish hinting at 7% inflation and reinforcing views that another 0.50% hike is coming in July.

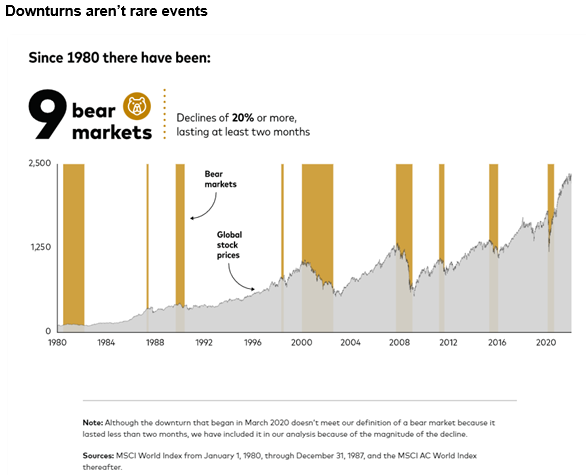

While investing in the stock market is typically a prudent choice for investors seeking long-term growth, sharp drops can still be uncomfortable. Investors, in all markets, will endure many of them during their lifetime.

So, when markets are in free fall what do we do?

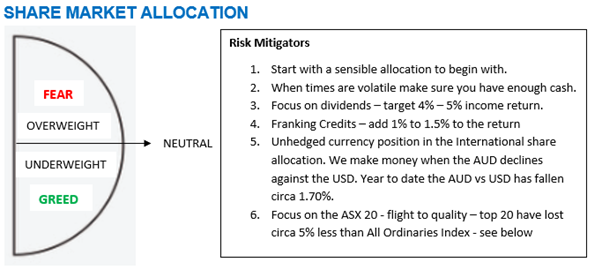

We often say that nobody can control the share market, not even the largest investment managers in the world, however we can control how much we have invested in the share market at any point in time. Changing the allocation to the share market is important during and investment cycle and a topic that is discussed at every progress meeting.

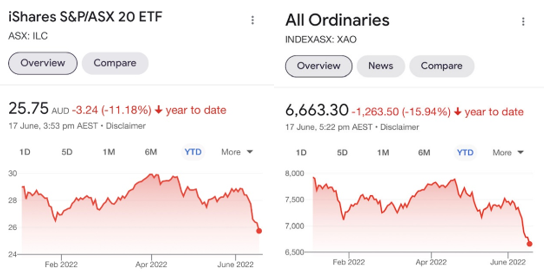

In times like these we need to focus on where we can achieve a positive return and aim at minimising losses, while waiting for the recovery that typically follows. As long as we invest in quality assets then, whilst it can be uncomfortable, we need to stay disciplined to the strategy.

The following outlines our approach to investing and how a proven investment philosophy can help your portfolio with stand market shocks.

FIXED INCOME – SECTOR ROTATION

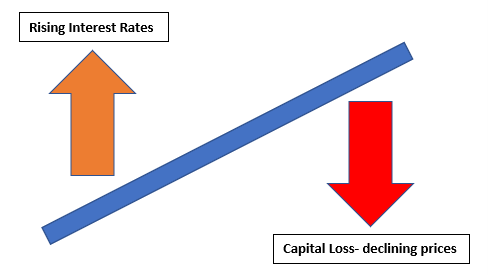

It is very important to rotate the investments within the Fixed Income sector based on the interest rate outlook. Currently the market is in Stage 1, and we are positioned as outlined in stage 2. The key question is when to move to Stage 3.

1) Rising Interest rates – reduce interest rate sensitivity - AVOID

As the chart below illustrates when interest rates are rising you want to avoid “fixed duration” securities which have lost circa 7% in the last 12 months. For every 1% increase in interest rates you can expect to lose circa 6% of your capital. With that magnitude of loss, it is hard to feel they are “Defensive” in this part of the investment cycle.

2) Floating Rate Credit and Term Deposits – HOLD / PROTECT

- Target return - cash plus 2%.

- Interest rate sensitivity is low at circa 0.3%, i.e., for every 1% in interest rate rise you lose 0.3% of your capital.

- Credit spreads are important

- Coupon – income payment

- Increase allocation to term deposits as the rates become more attractive, i.e., similar return with less risk. Ladder maturities so we can take advantage of rates as they rise, i.e., split the investment between 6 and 12 months.

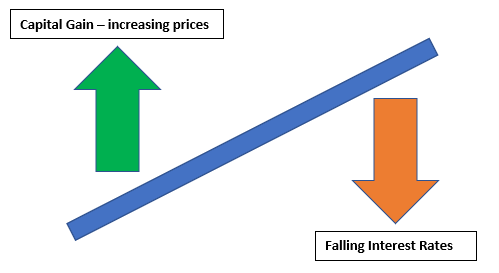

3) Falling Interest rates – increase interest rate sensitivity - GAIN

As the chart below illustrates when interest rates are falling you can make a very good return by taking on interest rate sensitivity, i.e., duration risk. For every 1% decrease in interest rates, you can expect to make a circa 6% capital gain. This is one area we will continue to be focused on in terms of the timing to allocate to this sector.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.

Copyright © 2022 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018