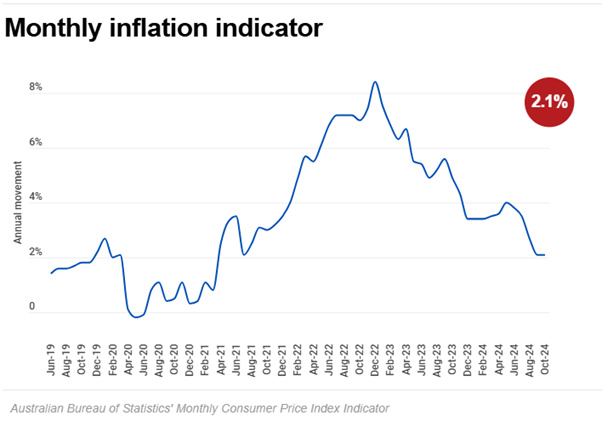

Reserve Bank of Australia (RBA) unlikely to lower interest rates in 2024 despite inflation at its lowest level since July 2021

The monthly inflation (CPI) indicator, released last Wednesday, rose 2.1% in the 12 months to the end of October. The all-important trimmed mean, or underlying inflation rate which the RBA monitors, however rose to 3.5% for the month of October. In September this measure was at 3.2% The trimmed data removes volatile aspects of the consumer price index basket, including oil and electricity.

Click here to read more.

- Electricity prices fell 35.6% in the 12 months to October, down from a 24.1% annual fall in September. This is the largest annual fall for the monthly Electricity series on record. The combined impact of Commonwealth Energy Bill Relief Fund (EBRF) rebates in all States and Territories and State Government rebates in Queensland and Western Australia drove the fall in electricity prices.

- Automotive fuel prices fell 11.5% in the twelve months to October, which follows an annual fall of 14.0% in September. Fuel prices fell 0.1% in October and have fallen in five of the past six months with lower global demand pushing down the global price of oil.

- Food and non-alcoholic beverage prices rose 3.3% in the 12 months to October, unchanged from September. Fruit and vegetables was the main contributor, rising 8.5% in the 12 months to October, driven by higher prices due to lower supply for avocados, berries, and vegetables such as cucumber and broccoli. Dairy and related products was the only food category to record a decrease annually driven by price falls for milk, cheese and ice cream.

- Holiday travel and accommodation prices rose 8.0% in the 12 months to October, up from a rise of 2.5% in the 12 months to September. This increase in annual growth is primarily due to base effects with a large 7.0% fall in October 2023 no longer contributing to the annual movement in October 2024.

What do the inflation numbers mean for interest rates?

The Australian Bureau of Statistics (ABS) figures for October are part of the bureau's relatively new series of monthly inflation data, which was brought into play as Australians and the world were experiencing inflationary shocks.

The monthly figures do not capture everything that ends up being included in the traditional quarterly figures, causing economists to be careful about how much should be extrapolated from them.

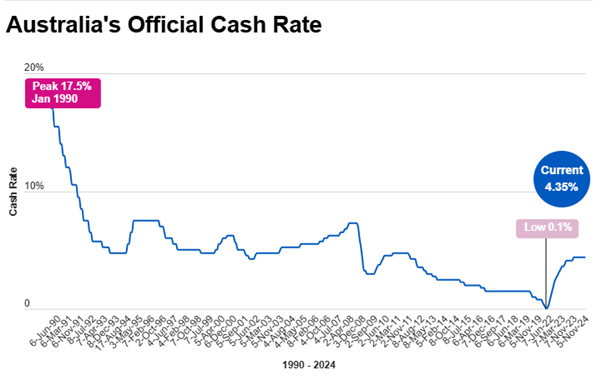

The RBA started rising interest rates from a historic low of 0.1% in May 2022, to cool down the economy and try to bring down soaring inflation. The cash rate is now at 4.35%, its highest level in around a decade.

The RBA meets again on December 10 to discuss interest rates, and it is widely anticipated there will be no change.

Copyright © 2024 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018