Reserve Bank of Australia (RBA) very likely to lower interest rates in May 2025

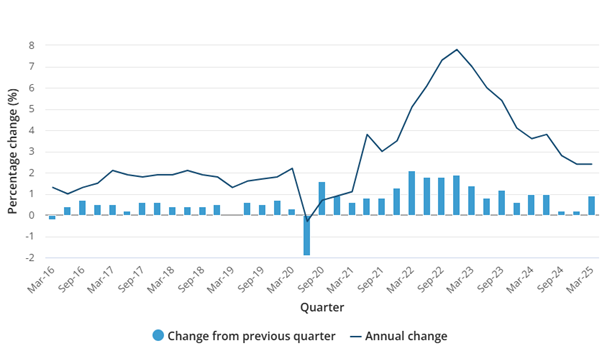

The quarterly inflation (CPI) indicator, released last Wednesday, rose 0.90% and 2.4% in the 12 months to the end of March 2025.

The Trimmed mean inflation provides a view of underlying inflation by reducing the effect of irregular or temporary price changes that can impact the CPI. Trimmed mean annual inflation was 2.9%, down from 3.3% in the December quarter. This is the lowest since December 2021.

Click here to read more.

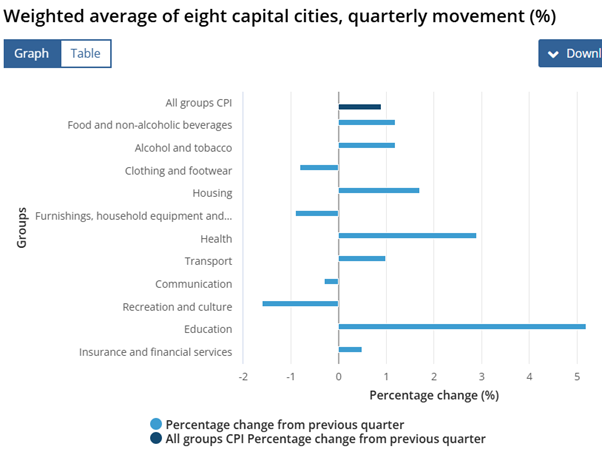

- Electricity prices rose 16.3% in the March quarter. This follows falls of 17.3 per cent in the September quarter and 9.9 per cent in the December quarter due to the introduction of the second round of the Commonwealth Energy Bill Relief Fund (EBRF) rebates from July 2024, which was expanded to include all households.

The rise this quarter was expected as most households in Brisbane have used up the $1,000 Queensland State government electricity rebate resulting in higher out of pocket electricity costs. Some households in the remaining states and territories also saw increases in the amounts payable on their electricity bills this quarter compared to last quarter. This was due to the impact from the Commonwealth EBRF rebates being lower in the March quarter compared to the December quarter due to the timing of rebate payments. Households in some states and territories received catch up payments (two $75 instalments) in the December quarter compared to only one instalment of the EBRF this quarter.

Excluding the rebates, electricity prices would have risen by 0.4% in the March 2025 quarter. Despite the quarterly rise, electricity prices are down by 11.5% compared to 12 months ago.

- Education, which covers primary, secondary and tertiary education, rose 5.2% in March quarter 2025. The rise was driven by an increase in Preschool and primary education (+5.6%), and secondary education (+6.4%), as higher operating costs were passed through as higher fees. Tertiary education (+3.6%) rose following the indexation of higher education course fees.

- Food prices rose 3.2% over the 12 months to the March quarter, up from 3.0% in the December quarter. Meat and seafood prices rose 4.3% compared to 12 months ago, the largest annual increase since the December 2022 quarter. The rise in Meat and seafood prices was driven by lamb and goat prices increasing by 19.7% in the past 12 months. Fruit and vegetable prices (+6.6%) continue to remain elevated. Fruit prices were up by 12.2% compared to March quarter 2024 due to higher prices for avocados, bananas and strawberries.

What do the inflation numbers mean for interest rates?

The RBA cash rate is now at 4.35%, its highest level in around a decade.

The RBA meets again on May 19 to discuss interest rates, and it is widely anticipated there will be at least a 0.25% rate cut.

We expect three 0.25% rate cuts in 2025 which is great for borrowers and not so great for depositors.

![]()

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018