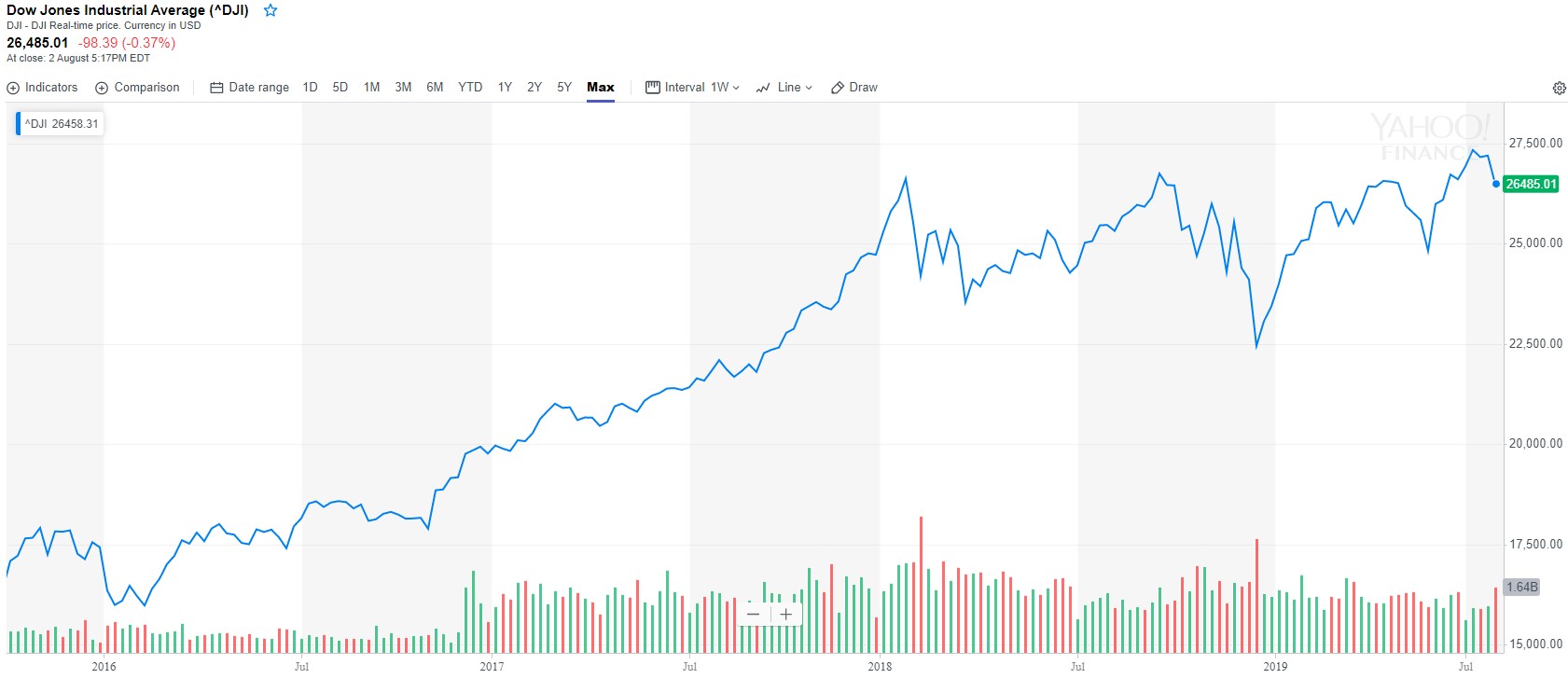

Trade tariffs and the US cuts interest rates

Apparently, there’s nothing like a presidential tweet to send ripples across all financial markets. In this case, President Donald Trump’s announcement via Twitter on Thursday last week that he plans to impose a 10% tariff on an additional $300 billion of Chinese goods showed that worries about global growth prospects remain a raw nerve.

Coming after the disappointment in the Fed’s rate-cut message, shares now face a “double whammy,” Investors are being hit on two fronts as rising trade tensions hurt the growth outlook on the one hand, while the Fed simultaneously seems a little less willing to keep cutting rates. It makes it harder to predict what earnings will look and that makes increased volatility more likely.

Arguably, last weeks retracement followed a very positive period thus far in 2019, so it was not huge surprise to give some of these gains back.

The Federal Reserve has reduced America's benchmark interest rate for the first time since December 2008, but US President Donald Trump is not impressed.

Mr Trump, who agitated for a "large" cut earlier this week, was disappointed to learn the Fed had only cut rates by 0.25%, and it could potentially be a one-off.

President Trump tweeted on Wednesday last week "As usual, [Federal Reserve chairman Jerome] Powell let us down, but at least he is ending quantitative tightening, which shouldn't have started in the first place — no inflation. We are winning anyway, but I am certainly not getting much help from the Federal Reserve! What the Market wanted to hear from Jay Powell and the Federal Reserve was that this was the beginning of a lengthy and aggressive rate-cutting cycle."

The thing is there wasn’t a clear and compelling case for a cut, and Jerome Powell failed to make one. The Fed’s justification for the cut, and the reason it seems to be unsure what its next move might be, is Trump’s trade wars and their effects on the global economy, and China and Europe in particular.

The US Fed’s move makes it more likely that other central banks – the European Central Bank, the People’s Bank of China and our Reserve Bank – will respond with their own cuts and other measures to protect their already-deteriorating economies, and prevent a weakening of the US dollar (shown below) from damaging their competitiveness, i.e. a lower USD makes America’s exports look more attractive and hence stimulates growth.

If other central banks respond to the Fed decision it would, of course, set Trump off again, and also increase the likelihood of the US adding a currency war to its trade wars - something Trump has been seriously contemplating and hasn’t ruled out.

AUD vs USD – year to date 2019