Mid-Year Market Outlook

As the 2025 financial year ends it is timely to reflect on the first 6 months of 2025 and importantly think about what we can expect for the next 6 months.

Russell Investments is the 3rd largest Investment Manager in the world with circa USD$430 billion under management.

Please click here to read their Mid Year Global Market Outlook: Shaken, not Stirred, or watch the 3 minute video.

Key topics of interest include:

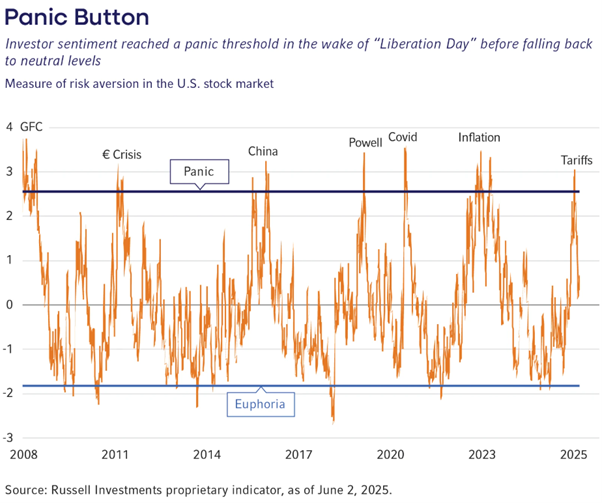

- Shaken - President Trump’s “Liberation Day” tariffs shook that fragile balance and drove one of the sharpest selloffs in market history.

- Stirred - The U.S. administration hot the pause button on tariffs shortly thereafter, taking off all the reciprocal measures from Liberation Day. The pause proved decisive for markets, neutralising the most extreme downside scenarios for the economy and revitalising investor sentiment. While equity and credit markets have recovered as we approach the midpoint of 2025, volatility in policymaking is still reverberating across the economic landscape and asset prices.

- Less exceptional - On balance, we expect slower but still positive growth in the second half of the year, reflective of a soft-landing scenario.

- Closing brief - The bounce-back in markets has been impressive, and it’s likely the rally could continue into the second half of the year. But the turbulence from April is a useful reminder that investors, regardless of their ultimate mission, should consider strengthening their portfolios to navigate the uncertain path that lies ahead.

- Regional snapshots

- Asset class preferences

Copyright © 2025 Coastline Private Wealth, All rights reserved.