This will be the last weekly strategy note for 2019 and we wanted to take this opportunity to thank all our clients for their patience and understanding this year and for continuing to trust our business to help you with your financial affairs. It has been a big year on a number of fronts including:

For Coastline Private Wealth:

- Our licensee since June 2015, Securitor Financial Group, announced in March they were closing as at 30 September and following an extensive due diligence process we successfully transitioned to our current licensee Oreana Financial Services in July.

- Our office lease expired this month after 5 years in West Leederville and we successfully negotiated new office premises and fit out in Wembley. We look forward to you meeting you at our new offices in 2020!

- Our team has expanded from 5 to 6 (three full time and three part time) as we adapt to the regulatory fallout from the Royal Commission and to ensure we can continue to provide the level of service expected from us.

- Next year Joel and Alastair will need to sit the 3-hour FASEA (Financial Adviser Standards and Ethics Authority) Exam to be able to continue providing advice.

- We have assisted 11 clients with personal insurance claims ranging from Income Protection, Trauma and Total & Permanent Disability, totalling over $3,000,000 in benefit payments.

For the Financial Services Industry:

- Over 4000 Financial Advisers (circa 15%) left the industry in 2019 with many more expected to leave by 2024 as they fail to meet the newly introduced minimum education requirements.

- The big 4 banks (ANZ, WBC, NAB and CBA) have largely exited providing financial advice to their customers as they struggled to get the commercial viability vs risk right.

- New FASEA code of ethics commencing as at 1 January 2020. There is still a lot of grey area in how this new code of conduct will be applied by the regulator.

- The announcement of grand fathered commission ending as at 31 December 2020 – this can only be seen as a positive in our view with an increase in in transparency and the move to a professional industry continues.

- Tightening of lending requirements driven by the regulator (APRA) with a focus serviceability and accurate expenses make it harder for people to attain credit.

For Investment markets:

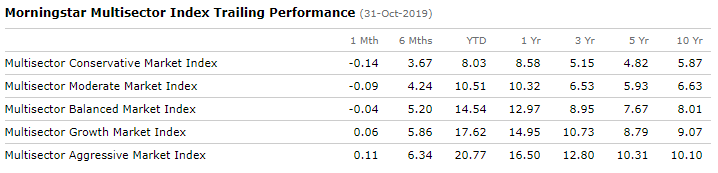

- Besides all the noise that might make you think otherwise, global share markets performed very well in 2019. This has translated to solid portfolio performance which can be seen below for various risk profiles to the end of October:

- The Australian official cash rate was cut 3 times from 1.50% to 0.75% - it is the lowest rate in history with many expecting a further cut in 2020. Investors are not surprisingly looking for alternatives as a result of low cash rates, however are they taking on more risk at the exactly the wrong time?

- US China trade war heats up and will continue into 2020. This will continue to contribute to volatility as the US and China flex their political and economic muscles.

- A number of key signals raise concerns for the share market outlook including an inverse yield curve, slowing economic growth, a fall in confidence surveys, negative ISM Purchasing and Manufacturing Surveys, etc.

- The AUD fell from circa 72c to the USD to 68c which is depreciation of circa 5.5%. It is widely expected the AUD might fall to circa 60c to the USD in 2020, although currency can be very difficult to predict. This is great for Australian exports but not so good international travelers!

For the Personal Insurances industry:

- Last minute opt in legislation was announced for inactive and small account balances requiring clients to opt in to maintain existing cover or be cancelled automatically.

- Continued pressure on profitability by major insurers and increased focus on premium sustainability means an active approach needs to be taken to manage risk and cost.

- It has been a year of dramatic changes in the providers of insurance with all but one bank selling their insurance businesses to specialist insurance companies and a number of new entrants in to the personal insurance market.

- An increased focus by the ATO in terms of the tax deductibility of certain benefits included in the Income Protection policies.

On a personal note the team at Coastline Private Wealth wish you and your families a festive end of year and Happy New Year heading into a new decade, 2020!

Please note we will also be taking some time off to spend with our families and the office will be closed from Monday the 23rd of December and returning on Monday the 13th of January. If your matter is urgent, please call the office number as the phone line will be diverted and we will be checking emails on a regular basis.