Co-vid collapse – the economy is held together with duct tape by JobKeeper and JobSeeker

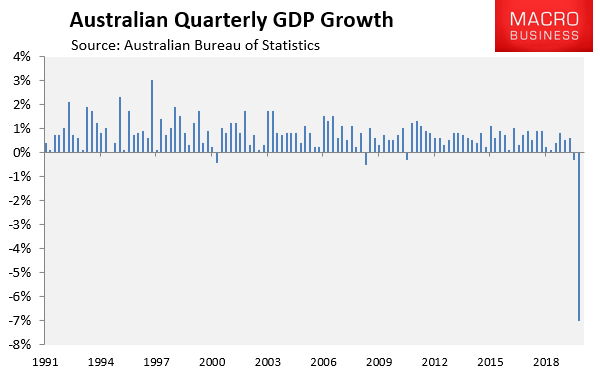

Australia is officially in its first recession for almost three decades with the June quarter GDP numbers showing the economy went backwards by 7% — the worst fall on record and slightly worse than most economists had predicted. It is the first recession since 1991, although the scale of the downturn is vastly greater than "the recession we had to have", where the economy shrank 1.3% and 0.1% per quarter. The 7% quarterly GDP slump was also more than three times worse than the previous biggest fall of 2% in June 1974.

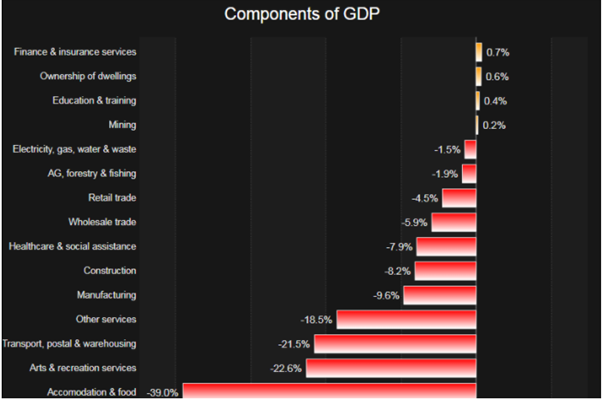

Which sectors were hit hardest?

With changes to JobKeeper and JobSeeker coming into effect at the end of the month we are expecting unemployment to rise as a number of businesses will no longer qualify for JobKeeper and commence making structural changes to their work force.

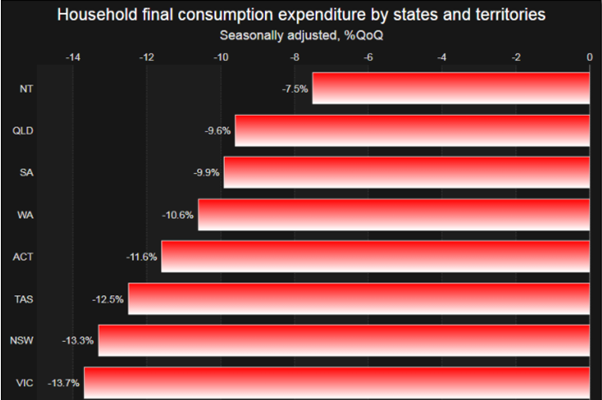

Which states were hit hardest?

There are perhaps no surprises that the states with the most cases had the worst economic performance.

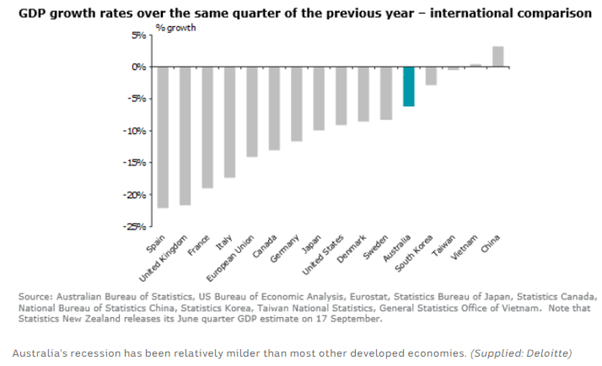

How does Australia’s GDP numbers stack up to other developed countries?

While this might be Australia's worst recession on record, it is not as bad as the downturns experienced in countries which have suffered worse coronavirus outbreaks.

How did the Australia Share Market react?

On Wednesday last week, the day the Australian GDP numbers were released, the ASX 200 increased by circa 1.80% followed by a further increase of circa 0.75% on Thursday. As you can appreciate this is extremely puzzling from a fundamental investing point of view.

Then last Thursday night the big US tech stocks sold off and the market took a breather from its bullish run – this caused the ASX to sell off by nearly 3% Friday and demonstrates how quickly things can change.

Our approach has always been to look after your retirement savings like our own. Right now, our deliberate strategy is to remain underweight growth assets to see how the next 6 months plays out. This may be cautious approach however we are focused on keeping client’s capital intact and holding sufficient cash for when risk assets, i.e. shares, look more attractive from a valuation perspective.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.