Australian consumer spending habits and CO-VID 19

Despite strong signs of an economic recovery, the Australian consumer remains guarded when it comes to confidence around spending. The main concerns centre on employment, cash flow certainty, managing personal finances, building and protecting future wealth, and planning for retirement.

Although many restrictions have been lifted around Australia, we’re not seeing a significant positive momentum shift in consumer spending, although most financial indicators are stable. It is estimated that Australians have stockpiled around $200 billion in savings during the Pandemic. According to the Westpac COVID-19 research tracker:

- 58% of households have already had a reduction in their household income as a direct result of COVID-19.

- 33% of households are struggling to meet their financial commitments.

- 29% of consumers plan to save more post the pandemic than they did before.

- 71% of consumers have already cut their spending, held off making large purchases or held off borrowing.

The rapid increase in online spending has slowed, and, for those in states with eased restrictions, a return to more ‘normal’ consumption habits are resuming. However, it’s likely the increased appetite for spending via online channels will stay with us beyond the pandemic.

Five drivers of consumer spending

Even when we’re not in the middle of a global pandemic, five basic factors influence consumer spending habits.

1. Disposable income

Arguably the single most important driver. Without disposable income, consumers wouldn’t have money to buy anything. In the classic supply and demand balance, as income increases so does demand. Manufacturers respond to meet demand, this creates jobs, wages rise and there’s ultimately more spending – a big tick for the economy.

The key aspects of generating a higher disposable income include boosting the hours worked by employees, government investment, and more training or education for workers.

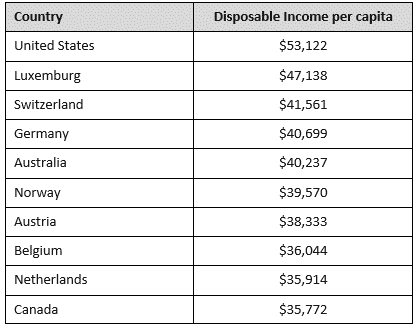

2. Income per capita

The amount each person has to spend is a good indicator of whether the standard of living is improving or falling. The following disposable income per capita figures for the top 10 countries are from the Organisation for Economic Co-operation and Development (OECD) as of 2018.

3. Income inequality

Different parts of the economy, and society, see incomes rise at a faster pace than others. The economy benefits most when low-income earners enjoy a rise in income as they spend a greater share of each dollar on essential items. High-income earners are instead more likely to save or invest their extra money.

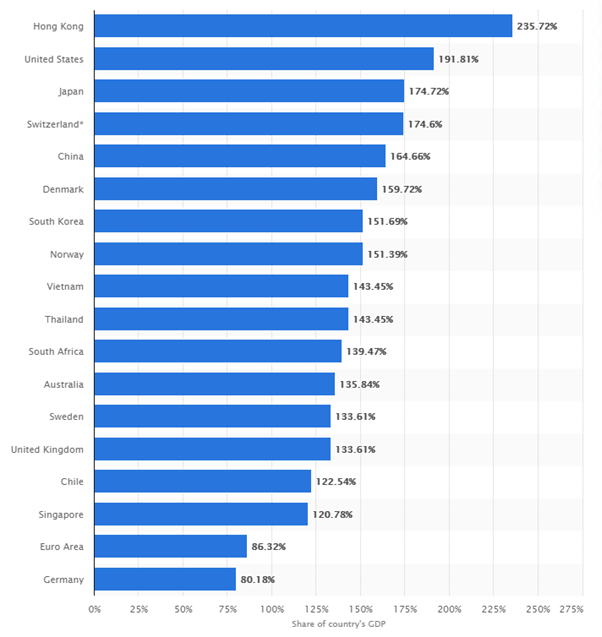

4. Household debt

This includes the level of credit card debt, car loans and personal loans and other fixed cost commitments. The table below illustrates total household debt as share of GDP in selected countries worldwide in 2019.

5. Consumer expectations

Confidence breeds confidence, and confident consumers are more likely to spend. High inflation expectations also drive activity with consumers generally incentivised to buy now and avoid future price increases.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.