What does inflation mean for the stock market? It’s supposed to be a positive —but investors are nervous.

Inflation is supposed to be largely positive for the stock market, but signs of growing price pressures are rattling share markets around the world over the past 2 weeks, a potentially confusing scenario for investors.

The positive relationship with more cyclically oriented shares probably hasn’t been abolished, but investors should make some allowance for heightened volatility around data as the market wrestles with an economy roaring back from an unprecedented sudden stop caused by the COVID-19 pandemic.

Inflation – what you need to know.

Inflation measures the rate at which the purchasing power of money erodes over time. Money acts as a medium of exchange and as a store of value. As a store of value, money’s purchasing power is entirely dependent on price levels. As prices inflate, each unit of money becomes increasingly less valuable.

Money isn’t unique as a store of value – people often choose to hold wealth in other assets like shares, bonds and property. However, these assets generally have to be converted into money before the wealth that they hold can be exchanged for other goods and services.

The negative effects of inflation are easy to see. People need to hold some wealth in money for transactions and unforeseen expenditures, inflation ultimately acts to diminish this portion of wealth until wages increase.

On the upside, however, stable levels of inflation are correlated with lower unemployment (this could be because expected higher prices stimulate business investment, or because the demand for consumer goods and services has surged).

What does higher inflation mean for shares?

Unfortunately, the relationship between inflation and share prices is not straightforward, and no catch-all rule can be applied. A prudent investment or trading strategy would require a thorough analysis of the specific characteristics of each stock under review. With this said, prevailing wisdom indicates that there are certain guidelines that could help in such an analysis.

Inflation and shares in the short run

Analysts suggest that the short-term dynamic is less favourable, and that the relationship between share prices and inflation is (quite frequently) an inverse correlation – i.e., as inflation rises, shares prices fall, or as inflation falls, stock prices rise. The adverse effect of inflation on stock prices in the short term could result from a range of factors, including:

- Falling short-term revenue and profits creating a drag on share prices

- A general economic slowdown, resulting in an unfavourable macroeconomic environment for the stock market and consumer spending in general.

- A monetary policy response that induces higher short-term interest rates, causing investors to substitute shares for lower priced bonds.

- The prospect of lowered, or even negative, real returns lowering the demand for share investment. In inflationary environments, investors need to make higher returns from a share portfolio to ensure a positive real return. For example, if you make a 4% gain from your portfolio yearly, that’s a real return of 3% when inflation is 1%. But if inflation were to rise to 5%, you would earn a negative real return.

Inflation and shares in the long run

For investors, shares can act as a hedge against inflation in the long run. This means that the monetary value of a stock or share portfolio can appreciate over an inflationary period so that the ‘real’ wealth it stores – the goods or services it can be exchanged for – remains constant despite higher prices.

In the case where inflation stems from higher input costs (known as cost-push inflation), for example, once businesses have had enough time to adapt to the inflationary pressures and to adjust their own prices, revenues will increase, and normal profit rates may resume.

The higher input costs are simply passed on to consumers after a period of price revision. The economic logic here would also imply that this is probably more realistic for a well-diversified portfolio rather than an individual stock that carries its own idiosyncratic risk.

The performance of income shares during high inflation

Because income shares pay regular and stable dividends, which may not keep up with inflation in the short run, their price will decline until the dividends rise to meet inflation.

International companies might also experience falling share prices when inflation increases: if a company raises prices too much, it runs the risk of becoming uncompetitive if foreign players operating in the same market are able to keep prices constant.

Lower inflation, interest and the business cycle

A significant feature of inflation policy is an increase in the short-term interest rate (sometimes referred to as the ‘tightening of monetary policy’). The higher cost of borrowing results in less investment spending by businesses and households, and those with disposable income prefer to hold interest-earning assets rather than depreciating money.

Real economic output slows, but so does inflation – if the monetary authority has acted correctly and is judged by the public to be trustworthy and effective.

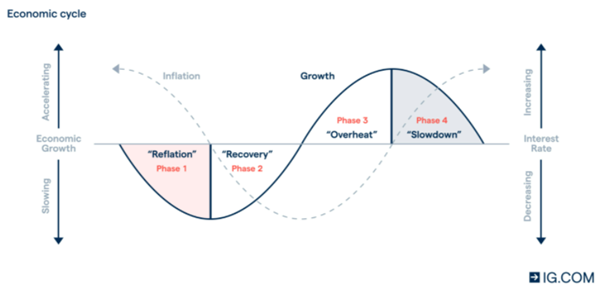

Conversely, when inflation is low, interest rates may also drop – acting as an incentive to spend on investment. As can be seen in the above graph, in the business cycle, growth is intimately linked with both a lower interest rate and lower inflation.

The implication is relatively straightforward: when consumers and businesses spend, general economic growth should result, on the whole, in solid returns on shares, whether through dividends or share price appreciation.

Please contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.