Financial year performance – what can we expect for 2020/21?

With June also shaping up to be a good month for investment markets what can we expect this financial year from a performance perspective?

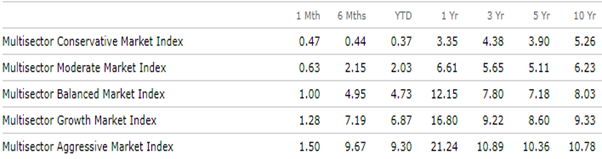

Morningstar Multi Sector Index Performance – May 2021

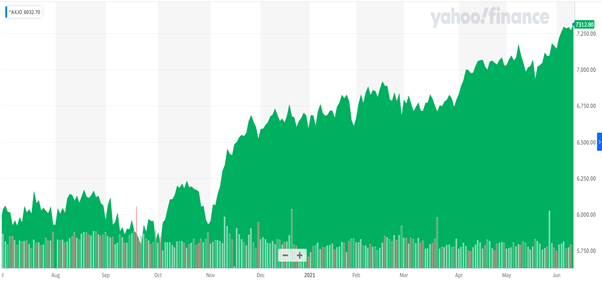

One of the key points from the table above is the 3, 5 and 10 year performance numbers which are in line with our broader forecasts. You can see by the chart below that we have seen a significant improvement since around October / November 2020 and now surpassed the pre Co-vid 19 ASX index high.

ASX 200 – 1 July 2020 – 10 June 2021 – excluding dividends.

Structural consideration to investing in June – Managed Funds.

When you invest in a managed investment you become a unit holder, i.e., the cash you invest is converted to a number of units that has an associated value. The unit price value then rises or falls based on the performance of the underlying securities. While the managed fund usually pays a monthly or quarterly distribution, the end of the financial year is very important from a tax perspective.

No matter if you are a unit holder for 1 day or 365 days, as of 30 June all unit holders are treated equally in relation to any distributions, which may include realised capital gains tax. Therefore, in a strong performance year you should be careful investing late in a financial year, unless the entity you are investing in is a pension (0% tax) or super (15% tax) account.

Please contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.

Copyright © 2021 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018