What’s causing the share market volatility at the moment?

Over the past 4 – 5 weeks the share market has been volatile with daily movements of over 1% and weekly movements of 2 – 3% not uncommon. While there are many factors that affect the share market, like a drop in iron ore prices, we believe there are 2 major reasons:

1) Inflation concerns

Inflation is defined by the rise in prices for a basket of goods and services. Inflation is important as central banks use it as a key measure of whether they should be increasing or decreasing interest rates. When the economy is performing well inflation increases and central banks will in turn increase interest rates with the aim of slowing the economy down. On the flip side if the economy is struggling central banks will reduce interest rates with the aim of stimulating the economy.

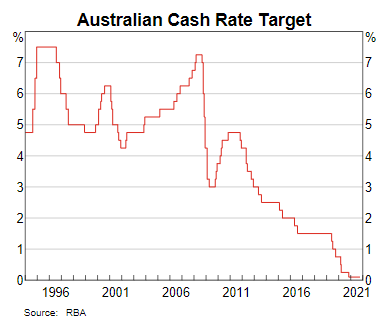

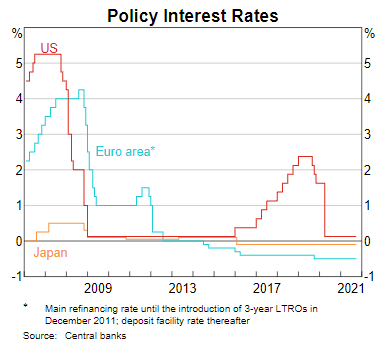

As we know we are currently in a record low interest rate environment and hence interest rates are set to rise. The only question is when, and by how much. The consensus for Australia right now is for the first interest rate rise in 2024, which is still quite some time away, however much sooner for the USA.

The share market however does not like higher interest rates as it affects the interest rate at which companies and households can borrow at, i.e., the cost of capital. Quite simply if the cost of capital is higher, then profits are lower or households have less to spend.

The other important effect of higher inflation is a reduction of purchasing power. Right now, this is a major issue as currently inflation is higher than what you receive in interest from cash held at the bank. Over time this means you will be able to buy less with the same amount of money.

2) Reduction of Government and Central Bank stimulus

The Global Pandemic in early February 2020 led to a massive halt in global growth and Governments and Central banks around the world stepped in to stimulate the economy. Governments have borrowed money for direct payments to those out of work and also spending big on infrastructure projects to create jobs.

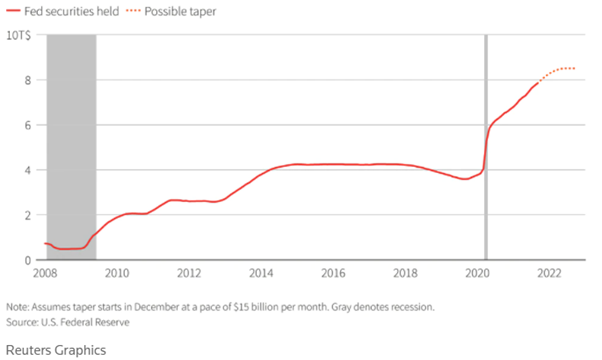

Central banks have made asset purchases, buying both equities and bonds, which has widely supported investment markets. The US Federal Reserve will have estimated to have purchased more than $8.5 trillion USD by the time the purchases cease in mid-2022.

As the global economy improves it would make sense that Government and Central Banks will scale back their stimulus measures however the market does not like this support being withdrawn. The key question in the short to medium term is whether private households and companies will fill the gap in economic recovery as the stimulus is withdrawn.

Summary

While in the short term the market will continue to grapple with these two key issues, in our view they should be seen as a positive outcome, i.e., it means that policy is working and the economy is recovering and performing strongly. We think both inflation concerns and the withdrawal of stimulus will continue to make news headlines for the next 12 – 18 months, which will likely cause small sell off’s from time to time, however the outlook remains positive.

Agreeing an investment blueprint for any excess cash will allow us to act with speed in a volatile market with the aim of minimising risk and not overpaying for assets.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.

Copyright © 2021 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018