What do you have planned for 2024?

2024 has given us the gift of another 365 blank pages. Will this year be the year to tick off one, or more of your ‘bucket list’ items; a fresh start or new venture; or simply finding the time to do more of the things you already enjoy doing.

What may seem like a long way away now, often sneaks up on us – its nearly the end of January - so it is important to start the planning process early. After all nothing that you really want is easy, so planning and focus is essential if you want to achieve your goals.

The key to realising your goals in 2024 is to make them specific, write them down, tell as many people as you can and store them in a place that can be visible every day, like the fridge for example.

Some common financial goals are saving for a holiday (for when borders re open), moving to your dream home, changing jobs, working out whether you are on track to reach financial independence, reviewing your wealth protection plan, starting an education fund, consolidating your super funds, or sorting out your Wills.

Investment market highlights from 2023

- After a very poor year in 2022 – the worst since the Global Financial Crisis in 2008 – 2023 ended very strongly with circa half the annual performance delivered in the final quarter.

- High interest rates and inflation continue to dominate headlines.

- Cash looked much more attractive on a risk adjusted basis and term deposits reached 5%.

- The AUD had a late surge against the USD.

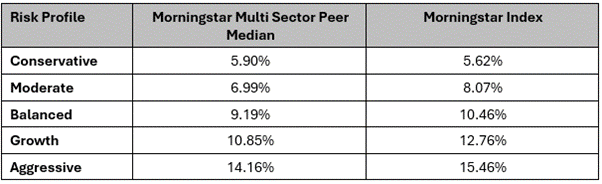

- The Multi Sector Peer Universe Median underperformed the index for 2023 - see below.

2024 Global Market Outlook

Russell Investments is the 3rd largest Investment Manager in the world with circa USD$430 billion under management.

Andrew Pease is the Head of Global Investment Strategy at Russell Investments, and he shares his views on the outlook for 2024. Key topics of interest include:

- The twilight zone – recession risk in US and Europe.

- The return of the 60/40 portfolio – the importance of diversification.

- The end of expansionary fiscal policy.

- Regional snapshots

- Asset class preferences

Please click here to read the full report or here to watch the 5 minute video.

Latest Key Economic Indicators from the Reserve Bank of Australia – 4 January 2024.

Copyright © 2023 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018