What is the RBA Rate Indicator saying today?

With inflation now in the desired RBA target band as at the 14th of February, the ASX 30 Day Interbank Cash Rate Futures February 2025 contract was trading at 95.74, indicating a 90% expectation of an interest rate decrease to 4.10% at the next RBA Board meeting tomorrow. This would be the first rate cut in 4 years.

The current official cash rate as determined by the Reserve Bank of Australia (RBA) is 4.35%.

Employment remains robust and firmer than the RBA’s own forecasts, and uncertainties remain around tariffs, their impact on the Australian economy.

It also seems likely that the next Federal election will be held in May. While this may not necessarily derail another cut, we cannot see it arriving at their next meeting in April, or in the month of the election.

![]()

Impact of a potential interest rate cut tomorrow

1) Relief for borrowers who have been feeling the cost of living pressures as many fixed rate loans locked in a few years ago have matured and the interest rate has increased from circa 2% to over 6%.

2) Bad for depositors as a reduction in interest rates will reduce savings interest rates on offer.

3) Mixed for the AUD as it is expected to depreciate against other major currencies.

a) Great for exporters as goods are more competitive on a global trading platform

b) Bad for importers and Australians travelling overseas

4) Stimulate growth – a lower interest rate will in theory, increase the incentive for consumers and financial institutions to spend and borrow money, which might then set the economy on an upward trajectory.

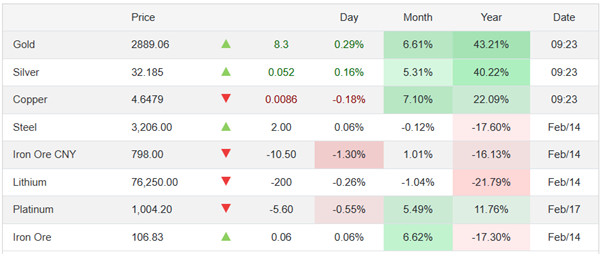

Commodity Prices and the AUD

How does the health of the Chinese Economy impact the Australian Dollar?

China is Australia’s largest trading partner, so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs. Tariffs by the US on China will likely affect demand for Australian raw materials, goods and services.

How does the price of Iron Ore impact the Australian Dollar?

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD. If there is a reduction in steel demand from China due to Tariffs there is a strong possibility the demand for Iron Ore will decline.

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018