Momentum driven markets

The all-time highs we are currently seeing from the ASX and other developed country share markets are nothing short of a dream for momentum investors, who try to ride the market wave. But if you are investing for the long term, momentum investing may not be the way to go. Momentum investing may be good over the short term but at times suffer from sharp drawdowns as they rely heavily on timing the market.

A good example of this was the US Dow Jones Index which fell by nearly 7% in last Thursday night’s trade after the US Federal Reserve chairman stated the US economy may take longer to recover than first thought. The very next day the Dow Jones then rebounded nearly 2% showing how volatile share markets are right now.

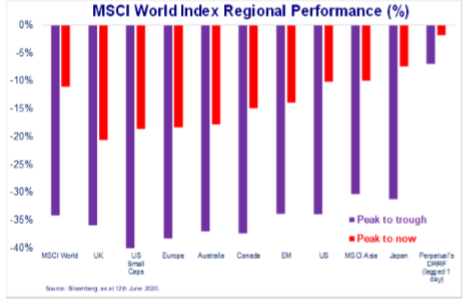

With such a strong rebound in share markets and the magnitude of daily volatility it suggests the foundation for such gains could be on shaky ground, as looming uncertainties around the pace of U.S. economic growth and how a post-corona virus economy will shape up continue.

Some analysts are attributing much of the nearly 40% surge in the U.S. share market since its late-March rally to inexperienced small investors with a voracious appetite for risk and a stimulus cheque in their pocket.

Another psychological driver of continued inflows into shares and other so-called risky assets, despite their swift run-up in the past few months, is that few see an alternative place to park their money. With interest rates at record lows, investors have been forced to look out to higher-yielding and more volatile sectors of the financial markets.

Investing on momentum alone is fraught with risk, since its success - or failure - is largely a function of behavioural biases. When momentum investors are all chasing the same shares, the market becomes crowded, and at the same time when sentiment changes a market downturn can see these shares lose the greatest value as investors race to the exit.

Please do not hesitate to contact us if you have any questions.

Kind regards,

The Coastline Private Wealth Team.