Quarterly living costs

All household types recorded larger rises in living costs compared to the previous quarter

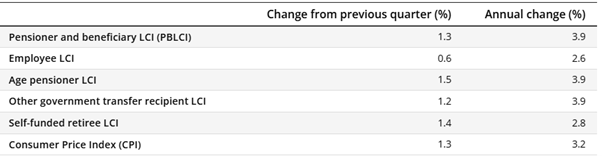

In the twelve months to the September 2025 quarter, all Living Cost Index’s (LCIs) rose between 2.6% and 3.9%, compared to annual rises of between 1.7% and 3.1% to the June 2025 quarter.

All household types recorded larger increases in living costs this quarter, compared to the June 2025 quarter. Age pensioner households recorded the largest rise in living costs this quarter.

Employee households recorded the smallest quarterly increase across the Living Cost Index's (LCIs) for the second consecutive quarter.

Housing and Recreation and culture were the main contributors to the rises in living costs across most household types this quarter. Rises in Transport, Food and non-alcoholic beverages and Alcohol and tobacco also contributed to increases in living costs. The main offsetting contributors were Health and Insurance and financial services, which fell for most LCIs.

All household types recorded rises in Housing costs due to increases in electricity costs and Property rates and charges. Out-of-pocket Electricity costs rose following annual price reviews in July and the timing of rebate payments for the extended 2024-25 Commonwealth Energy Bill Relief Fund.

Living costs for households whose main source of income is government payments

Living costs for Age pensioner (+1.5%) and other government transfer recipient (+1.2%) households and the Pensioner and Beneficiary LCI (PBLCI) (+1.3%) rose this quarter. Households represented by these indexes source their principal income from government payments.

The increase in living costs for these households was driven by an increase in Housing costs, due to rises in Electricity and Property rates and charges. Electricity and Property rates and charges make up a higher proportion of expenditure for these household types. Age pensioners, which recorded the highest quarterly rise, have the largest expenditure weight for Electricity and Property rates and charges across the LCIs.

The strong quarterly rise in electricity was driven by annual electricity price reviews which came into effect from July 2025 and increased electricity prices across all capital cities.

The timing of rebates also contributed to the large rise in electricity prices.

The Commonwealth Energy Bill Relief Fund (EBRF) rebates were extended for 6 months from July 2025 to December 2025. However, households in NSW and ACT did not receive payments of the extended EBRF in July. Payment of rebates for households in NSW and ACT commenced in August. Households that did not receive the EBRF rebate in July will receive two payments in October 2025.

Additionally, these household types saw a larger impact from using up various rebates in the previous quarter. The final payment of the 2023-24 Energy Bill Relief Fund (EBRF) rebate in Tasmania, which was paid across two financial years, and the remainder of the $1,000 State Government electricity rebate in Queensland were both used up in the previous quarter. These household types have relatively smaller electricity bill sizes, which means falls in rebates or increases in prices have a proportionally bigger impact on their out-of-pocket electricity costs.

Government payment recipient households saw offsetting falls in Health, due to a cyclical increase in the proportion of these households reaching the Pharmaceutical Benefits Scheme (PBS) safety net threshold this quarter, reducing their out-of-pocket expenses.

Self-funded retiree households recorded a rise of 1.4% this quarter

Self-funded retiree households, whose primary source of income is superannuation or property income, rose 1.4% this quarter following a 0.6% rise in the June 2025 quarter.

The main contributors to the rise were Housing, followed by Recreation and culture. The rise in Recreation and culture had a larger impact on Self-funded retiree households, due to Holiday travel and accommodation making up a larger proportion of expenditure for these households compared to other household types.

Employee households recorded the smallest rise across all household types (+0.6%)

Living costs for Employee households, whose primary source of income is wages and salaries, rose 0.6% in September 2025 quarter, following a 0.4% rise in the June 2025 quarter.

This rise in living costs for Employee households was partially offset by falls in Mortgage interest charges, which make up a higher proportion of expenditure for these households. Mortgage interest charges fell 3.8% due to banks cutting interest rates for both variable and new fixed rate home loans following the Reserve Bank of Australia’s decision to lower the cash rate target in May and August 2025.

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018