This will be the last weekly strategy note for 2025, so we wanted to take this opportunity to thank all of our clients for continuing to trust our business to help them with their financial affairs.

2025 has been another challenging year with heighted market volatility and continued Geopolitical risk.

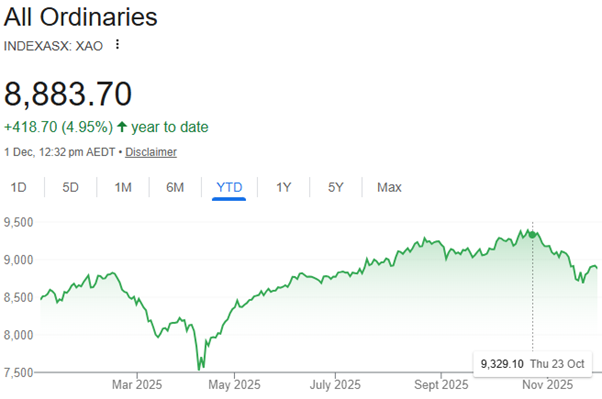

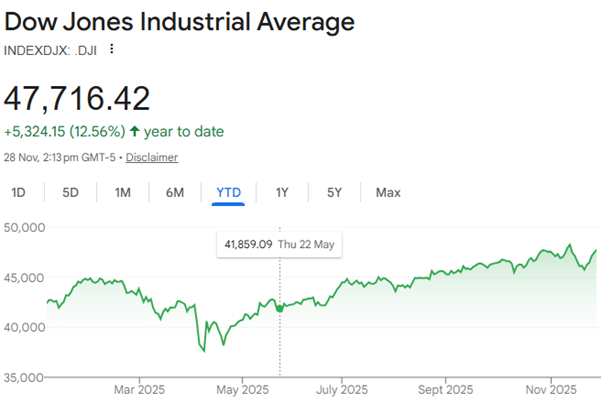

Investment markets – 2025 – supporting charts below.

- With only 4 weeks to go, performance for 2025 is looking very positive with most portfolio’s delivering high single digit to low double digit returns. This builds upon strong performance in 2023 and 2024.

- The Australian Share Market will likely end in low double-digit performance this year, when you include dividends i.e. circa 10 - 11%.

- The US Share Market has outperformed most global markets and will likely end in mid double-digit performance this year, i.e. circa 14% – 16% when you include dividends. Tech stocks continue to dominate performance attribution.

- Fixed interest investments will meet their objective of cash plus 2 – 3%, i.e. delivering circa 6% – 8% and cash has delivered circa 3 – 4%.

- The RBA cash rate was cut this year from 4.35% to 3.60% reflecting the need to stimulate a slowing Australian economy.

- Global share markets are trading at very expensive levels based when measured by the Price to Earnings ratio (P/E).

The Santa Clause Effect – is it repeatable?

The Santa Clause effect is a surge in the price of shares that often occurs in the week between Christmas and New Year's Day. There are numerous explanations for the Santa Clause Rally phenomenon, including tax considerations, happiness around the markets, people investing their end of year bonuses and the fact that the pessimists are usually on holiday this week.

CommSec analysed data over the past 70 years and found the Australian share market generally performs better in January, with the All Ordinaries rising in 50 of the 70 years and gaining 1.9% on average. December is not far behind, rising 49 times in the past 70 years and lifting on average by 1.8% during the month. Interestingly there is also one month that has consistently under-performed, which is June.

So the question remains, is there a ‘good’ or ‘bad’ time to trade shares? What returns will “Santa” bring this season?

As with any economic or financial data, a long period of analysis is required before a definitive result can be determined. Even with 70 years of data we are far from convinced that the trend is a reliable strategy for investors to depend upon. Certainly, the data shows that December, January and April have been stronger months in the past. It is important to know that the past will not always be a good gauge on the future, and consistency of investment usually trumps attempts to ‘time’ the market.

Office hours during the end of 2025

Please note we will also be taking some time off to spend with our families and the office will be closed from Monday the 22nd of December and we will be returning on Monday the 12th of January. If your matter is urgent, please call the office number as the phone line will be diverted to Alastair or Joel and we will also be checking emails on a regular basis.

The team at Coastline Private Wealth wish you and your families a festive end of year and Happy New Year heading into 2026!

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018