Vanguard's 2024 How Australia Retires report

Vanguard Australia is delighted to introduce the second edition of our How Australia Retires report, a study exploring Australians’ attitudes towards retirement and how they feel about this phase of life.

Traditionally, ‘retirement’ has been understood as a reference to the phase of life when one ceases full-time paid work or ceases paid work altogether. Participants in the study were not provided with a specific definition of ‘retirement’, so the results effectively reflect individuals’ subjective interpretations of ‘retirement’ which may vary.

Click here to read the full Report.

Key insights from this year’s report include:

- 1 in 2 Australians don’t know if their money will last in retirement, with the majority believing they’ll likely outlive their retirement savings

- 58% of Australians haven’t thought about how old they’ll live, and 67% do not know how long of a retirement to plan for

- 40% of Australians have no clear plan for retirement

- Many Australians don’t understand retirement; notable gaps in the retirement system and financial literacy exist.

- Expected retirement age differs from the reality: Nearly 50% of retirees retired earlier than they thought they would. The average retirement age reported by retirees was 61 years old, while working age Australians reported an average ideal retirement age of 62.6 but an average realistic retirement age of 67.9. These ages have increased relative to the responses given in last year’s How Australia Retires report which may reflect the sample surveyed or other factors such as the rising cost of living.

- Almost 1 in 2 Australians still don’t know what they pay in super fees.

- 1 in 5 Australians said they did not need a financial adviser right now, but they would consider consulting one later. With over 5 million Australians at or approaching retirement, and only 16,000 advisers practising as at December 2023, unmet advice needs will continue to grow if the barriers to seeking advice are not effectively addressed.

Vanguards aim for this research is to meaningfully contribute to our shared understanding of how people experience retirement in the context of Australia’s superannuation system. It joins Vanguard’s industry-leading research into practical and topical retirement matters in Australia and around the world.

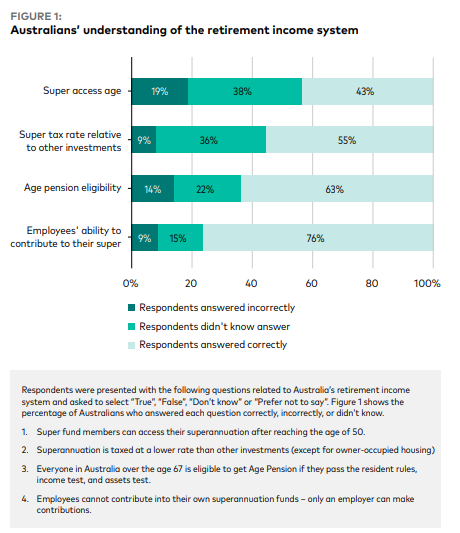

Australia operates a ‘three pillar’ retirement income system broadly comprising a means-tested, publicly funded Age Pension; compulsory, concessionally taxed superannuation savings; and voluntary, sometimes tax-advantaged private savings and other assets held both inside and outside the superannuation system. Findings suggest Australians have a patchy understanding of the retirement system:

- Almost 2 in 3 Australians lacked confidence or accuracy about the age at which they can access their superannuation.

- Almost 1 in 2 Australians do not know or are unsure if superannuation is taxed at a lower rate than other investments.

- 1 in 3 Australians do not know or are unsure of the Age Pension eligibility rules.

- Around 1 in 4 Australians do not know or are unsure if they are allowed to make additional contributions to their superannuation.

Copyright © 2024 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018