How presidential elections affect the stock market.

Click here to read the full article.

Media coverage of the US election is picking up. Despite a close, sometimes heated race, the election has yet to influence market dynamics.

One reason may be that voter preference polls indicate that the election outcome is too close to predict. With Biden stepping down this morning this could now all change.

Along with the headline Presidential race, one-third of the seats in the U.S. Senate (currently under narrow Democratic control) and all 435 seats in the U.S. House of Representatives (currently under narrow Republican control) are also on the ballot this fall. Here, too, a small margin may determine control beginning in 2025, with winners in many closely contested seats difficult to predict. It is conceivable that the election outcome could result in one-party control of both houses of Congress and the Presidency, or a split between the two parties, as exists today.

As the November election nears, investors are likely to be more attuned to the potential ramifications of the election for businesses, the economy and capital market. There are a number of unanswered questions about how policy could impact markets based on election outcomes.

Elections increase uncertainty and markets don’t like that. The 2024 election will probably be exceptionally tight, again decided by a slim margin in key battleground states. This underscores the importance of strategic planning for investors.

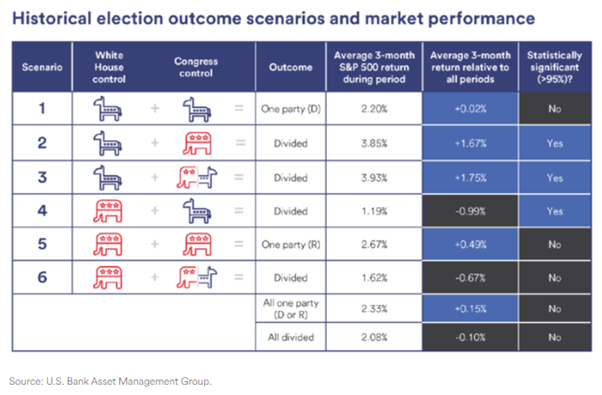

Election results can ultimately impact government policy, laws and foreign relations. But how do those results affect the market? And what are the potential ramifications for you as an investor? To better address this question, U.S. Bank investment strategists studied market data from the past 75 years and identified patterns that repeated themselves during election cycles.

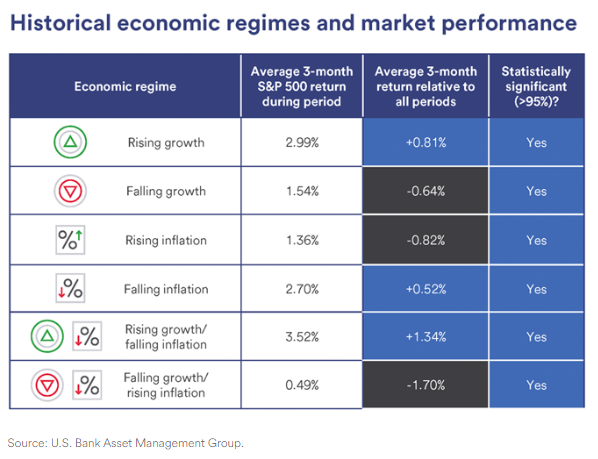

The analysis points to minimal impact on financial market performance in the medium to long term based on potential election outcomes. The data also shows that market returns are typically more dependent on economic and inflation trends rather than election results.

However, there are a few election scenarios that were associated with the potential for a slight impact on market performance. How have election outcomes affected market performance in the past and how might potential scenarios play out in the 2024 presidential election?

The composition and control of Congress resulting from the 2024 election is still up in the air but is another aspect of this year’s cycle that bears consideration. It also makes sense to keep an eye on which sectors are most likely to be affected by key policy changes. While the presidential election will likely dominate news headlines in 2024, keep in mind the general election on November 5 is still many months away.

Copyright © 2024 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018