How war in the Middle East could derail the global economy

Last week there was a very good article on ABC news – click here to read the full article.

When US President Joe Biden last Thursday casually dropped that he had discussed military strikes against Iran's oil export facilities with Israel, all hell broke loose.

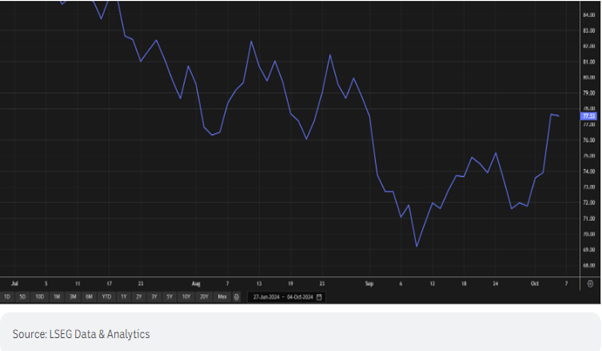

Crude oil prices, which in recent months have been languishing, immediately took flight, surging 5%. By the end of the week, they had stacked on 8%.

Iran’s Oil Supply

Iran has been steadily increasing its influence over global oil supply.

While it is a member of the Organisation for Petroleum Exporting Countries, it is not bound by the export and production quotas set by the cartel.

Iran now produces around 3 per cent of global output after lifting output faster than any other OPEC member in recent years and exports this year have reached multi-year highs.

Most of its oil lands in China although it claims to ship oil to as many as 17 countries, many of them surreptitiously. China's other main source of oil is Russia, also subject to sanctions since its invasion of Ukraine.

How does all this impact the Global economy and Australia?

The US has just declared victory from a bruising two-year battle with inflation, giving the US Federal Reserve the leeway to last month slash interest rates by 0.50%.

More cuts are scheduled in coming months, even as unemployment remains historically low with solid jobs growth.

Should Israel attack Iranian oil export facilities, however, analysts believe oil could surge almost 40 per cent, back towards $US100 a barrel, potentially igniting another bout of inflation.

Such a move would rule out any further chance of interest rate cuts, here and the rest of the world, possibly plunge America and the globe into recession and kill any chance of Kamala Harris becoming America's first female president.

As a major energy exporter, higher prices benefit Australia as a nation. Gas and coal prices generally rise as oil prices lift, companies earn bigger profits and pay more tax which lifts our national wealth.

The downside, however, is that fuel is a component in almost everything we consume, from food and shelter to clothes and chemicals.

That adds directly to the cost of production of almost everything, including the gear we import, which then forces prices higher.

A major spike in the cost of fuel would be enough to scare the Reserve Bank of Australia on potential rate cuts.

RBA may be forced to wait

It's been a hard slog for the Reserve Bank of Australia to ratchet down inflation.

When the Consumer Price Index for the all-important September quarter is released in a few weeks, many were hoping lower fuel costs would be a major contributing factor to further undercutting prices.

The June quarter showed inflation still uncomfortably high at 3.8 per cent but the low monthly numbers since have lifted calls for rate cuts within the next few months.

While that remains the hope, there's no doubt the RBA will have a sharp eye on the future.

The greater the risk of a widening regional confrontation and the potential for another oil inspired lift in inflation could be enough for it to keep rates on hold for longer than would have been otherwise expected.

Copyright © 2024 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018