How much super should I have today?

Now you can be a super sleuth and gauge your superannuation balance journey. Simply enter your age and ASFA’s Super Balance Detective will show you how much super you should have today.

Click here to find out what your super balance should be.

By the way we believe these numbers are the bare minimum based on the “comfortable” lifestyle not having sufficient budget allocation to travel for most of our clients.

How much do you really need for retirement?

One of the most important steps in planning to save for your retirement is figuring how much you will need to spend each year to live a “comfortable” lifestyle. However, many people struggle when it comes to developing a budget for their future needs, particularly when their retirement is many years away.

The Association of Superannuation Funds of Australian (ASFA) Retirement Standard has been developed to help solve this problem by objectively outlining the annual budget needed by the average Australian to fund a comfortable standard of living in their post-work years. It provides benchmarks for both a comfortable and modest standard of living, for both singles and couples, and is updated quarterly to reflect changes to the Consumer Price Index (CPI).

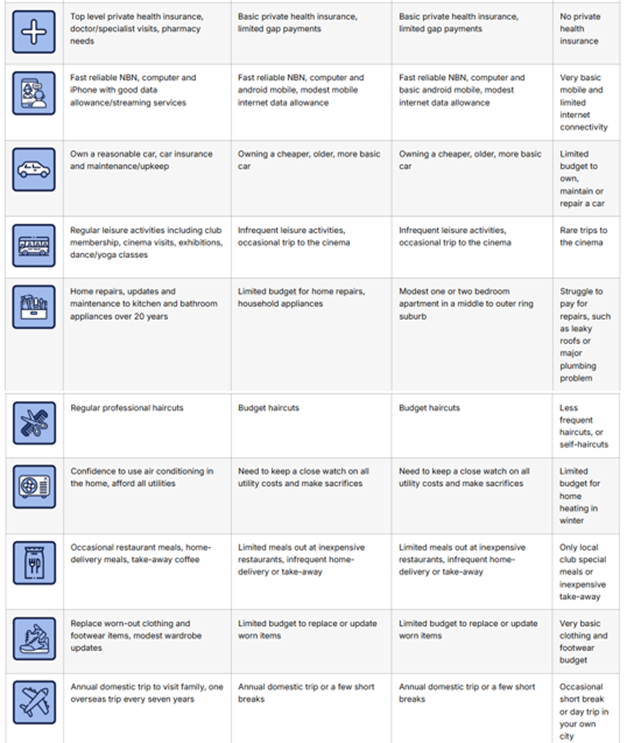

What is considered a modest and comfortable retirement lifestyle for those retiring between 65 – 84?

A "modest" retirement lifestyle is considered better than the Age Pension, but still only allows for the basics.

A "comfortable" retirement lifestyle enables an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as; household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel.

Both budgets assume that the retirees own their own home outright and are relatively healthy

Click here for a more detailed breakdown of the household expenditure.

While there are common themes we can identify as our clients either retire, or approach retirement, such as travel, the key is that everyone’s retirement goals are different. What might be right for one person is not the same for another. After all, let’s face it money does not buy you happiness - but it sure makes things easier and gives you more time to focus on experiences, goals, community, family and friendship. These are the things we can identify that help people feel valued and involved.

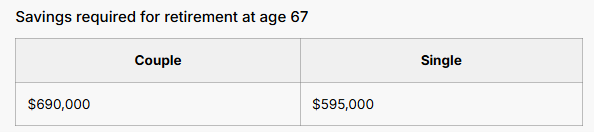

Superannuation balances required to achieve a “comfortable” retirement

The lump sums required for a comfortable retirement assume that the retiree/s will draw down all their capital and receive a part Age Pension.

By the way we believe these numbers are the bare minimum based on the “comfortable” lifestyle not having sufficient budget allocation to travel for most of our clients.

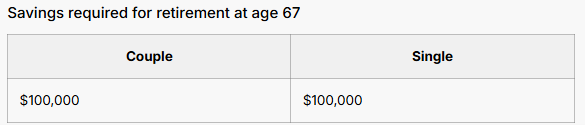

Superannuation balances required to achieve a “modest” retirement

The lump sums needed for a modest lifestyle are relatively low due to the fact that the base rate of the Age Pension (plus various pension supplements) is sufficient to meet much of the expenditure required at this budget level.

By the way we believe these numbers are the bare minimum based on the “comfortable” lifestyle not having sufficient budget allocation to travel for most of our clients.

Other factors that affect your retirement outcome:

1. Longevity risk.

Due to modern medicine we are now living longer unless there is family history to suggest otherwise. Health considerations are very important and being physically able to do the things you want to, is a major barrier as we get older. Do we out live our money or does it out live us?

2. Access to the Government Aged pension.

While the Government has increased the age to access the Age pension from 65 to 67, this can help you top up your income, via a full or part pension, to meet a “comfortable” retirement income when combined with the income derived from your savings and make them last longer. This is critical for many Australians and while the reporting to Centrelink can be a hassle it's worth it when you consider additional benefits, e.g. discounts on utility bills / medical prescriptions, free public transport etc.

3. Don’t be afraid to spend it.

The reality for most is that you will need to draw upon your capital in retirement to maintain your retirement lifestyle. After all it is your savings and from an intergenerational wealth perspective your children will most likely inherit your property assets, which given the increase in house prices will be substantial. Also, when you are 80 your children will most likely be in their 50’s and making financial decisions of their own. The rate at which it is drawn down is the key focus, ensuring you meet the goals you set and do the things you have always dreamed to do.

So, in summary, while it would be ideal for everyone to have over $1,000,000 in retirement savings it is possible to have less and still live an active, healthy and fulfilling retirement lifestyle and do the things you have always wanted to do.

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018