Reserve Bank of Australia – Interest rate on the rise

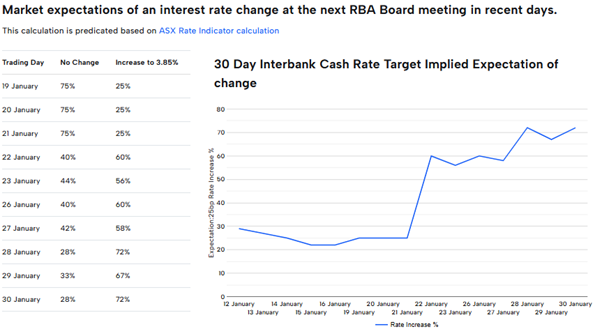

The RBA is widely expected to raise the cash rate by 0.25% to 3.85% on its 3rd of February 2026 meeting. This follows a surprise rise in annual inflation to 3.8% in the December 2025 quarter. Markets indicate a high probability (72%) of a rate increase to curb stubborn inflation – see below.

The RBA is expected to frame any move as an insurance hike — acting now to prevent inflation dynamics from becoming entrenched rather than signalling a full new tightening cycle.

![]()

Impact on Borrowers vs Depositors

A. Borrowers — Higher Costs Ahead

Key effects of a 0.25% interest rate rise:

- Mortgage repayments will increase, particularly for variable-rate borrowers. Financial stress indicators suggest that if rates rise, tens of thousands of mortgage holders will move into “at-risk” status (where repayments take a large share of income).

- For households already stretched by high living costs and elevated indebtedness, even a modest rate rise can meaningfully increase monthly outflows. Stress is most acute for borrowers with tight buffers or high loan-to-income ratios.

- Higher rates typically translate into stronger variable home loan rates almost immediately, as banks pass through RBA increases. Many lenders have already been adjusting pricing in expectation of policy tightening.

Here’s a summary of the average increase in home loan repayments you can expect if the Reserve Bank of Australia (RBA) raises the cash rate by 0.25%(i.e., a typical quarter-point hike), assuming lenders pass that increase on in full to variable mortgage rates (which is generally how it works in Australia):

Typical Increase in Monthly Repayments (Approximate)

|

Loan Amount |

Approximate Monthly Increase (0.25% hike) |

|

$500,000 |

~ $80 – $82 more per month |

|

$600,000 |

~ $94 – $98 more per month |

|

$750,000 |

~ $120 – $123 more per month |

|

$1,000,000 |

~ $157 – $164 more per month |

B. Depositors — Better Yields, But Slow Pass-Through

- Short-term benefits:

- A rate hike generally leads to higher deposit rates, particularly on high-yield savings accounts and short-term term deposits, as banks compete for funds.

- For savers, this means improved returns versus the ultra-low yields seen in recent years.

However:

- Banks often lag behind the RBA in passing through full increases to deposit rates compared with lending rates, meaning the benefit to savers may be smaller and slower than the pain felt by borrowers.

- Competitive pressure (and funding cost dynamics) may eventually force banks to lift deposit offerings, but the timing and magnitude can vary across institutions.

Broader Macro & Market Implications

- Inflation & growth balance:

If the RBA hikes, it signals that inflation remains the greater policy risk, even as the economy continues to show pockets of strength. This can weigh on risk assets and consumer confidence in the short term.

- Financial conditions:

Higher rates tend to tighten financial conditions, which can slow credit growth and dampen housing-sensitive spending, adding a drag on GDP growth later in 2026.

- Market sentiment:

Expect bond yields and the Australian dollar to adjust to higher rate expectations, while markets watch closely for forward guidance on further moves.

Copyright © 2026 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018