What do you have planned for 2020?

2020 has given us the gift of another 365 blank pages and the dawn of a new decade. Will this year be the year to tick off one, or more of your ‘bucket list’ items; a fresh start or new venture; or simply finding the time to do more of the things you already enjoy doing.

What may seem like a long way away now, often sneaks up on us – its nearly the end of January - so it is important to start the planning process early. After all nothing that you really want is easy, so planning and focus is essential if you want to achieve your goals.

The key to realising your goals in 2020 is to make them specific, write them down, tell as many people as you can and store them in a place that can be visible every day, like the fridge for example.

Some common financial goals are saving for a holiday, moving to your dream home, changing jobs, working out whether you are on track to reach financial independence, reviewing your wealth protection plan, starting an education fund, consolidating your super funds, or sorting out your Wills.

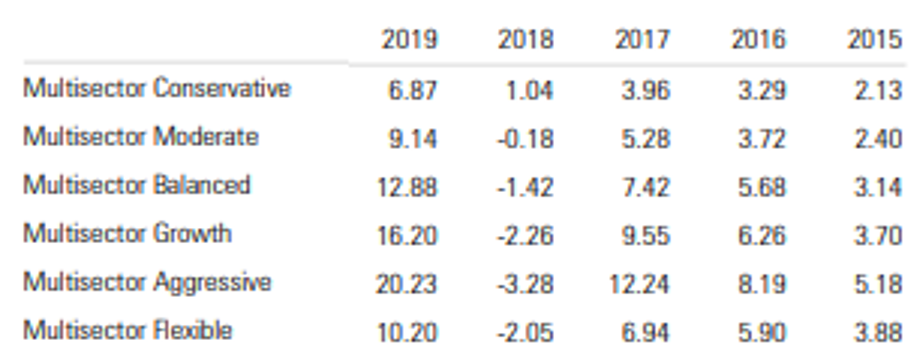

Portfolio Performance - 31 December 2019

2019 was dominated by falling interest rates and trade wars between the US and China, however it was also one of the strongest years on record for developed country share markets, including Australia.

Below illustrates benchmark returns for various Morningstar risk profiles, i.e. allocation to growth and defensive assets. As you can see 2019 was the best performing year in the last 5 years and by a long way.

Portfolio Positioning and Outlook for 2020

As global share markets have been rising to all-time highs it is prudent to start taking risk off the table, i.e. reducing the % allocation to growth assets. To be clear that doesn’t mean being overly pessimistic and converting 100% to cash. It means adjusting the portfolio to an underweight position to the benchmark you feel most comfortable with, i.e. for Balanced investors reducing your exposure to growth assets to 55% – 60% with a benchmark of 70%, for Moderate investors reducing your exposure to circa 40% - 45% with a benchmark of 50%.

Even with an underweight position both Balanced and Moderate investors have still participated in the current share market rally in a meaningful way however importantly are ready for what may be waiting just around the corner.

We understand investors all want the maximum return available however we also understand they want to avoid significant losses. Taking an underweight approach in the current environment does mean we miss out on a little at the top of the market but what it does provide is downside protection if there is a significant share market correction. The psychology of investor loss aversion confirms this a sound investment strategy to adopt.

Even with taking less risk the majority of our client portfolios outperformed the Morningstar Multi sector median returns, after fees, for 2019 which is very pleasing.

Markets appear to be impressed by the substance of the U.S.-China trade deal, unveiled by President Trump at a White House signing ceremony last Wednesday. The market wasn’t expecting China to commit to purchasing as much as $200 billion in additional U.S. imports over 2017 levels in calendar years 2020 and 2021, nor did investors predict that manufacturing and energy products would compose such a large portion — $115 billion — of the overall commitment.

The key question for 2020 is whether the recent trade deal will lead to higher corporate profits to support the rally in share prices?