Federal Budget – tomorrow - what we know so far.

With the Federal election required to be held by the 17th of May the Australian federal Budget has been brought forward from May to the 25th of March this year, i.e. tomorrow.

The big challenge for the Federal Government is to deliver a budget that stimulates growth in the economy and addresses cost of living relief, however at the same time is not inflationary.

After two straight surpluses the treasurer, Jim Chalmers, has already indicated there will be a budget deficit (spending more than the revenue received). Here are some of the announcements thus far:

- Bulk-billing and PBS medicines: The federal government unveiled in February an $8.5 billion boost for Medicare to expand bulk billing. It also announced a $689 million pledge to reduce the maximum cost of a majority of medicines listed on the PBS down from $31.60 to $25, if re-elected.

- Cost-of-living relief: Mr Chalmers committed to extending energy rebates, promising a $150 discount applied across quarterly instalments. .

- Help to buy scheme changes: Labor wants to broaden the scheme, which allows homebuyers to co-buy their property with the government, so it includes people with higher income and applies to more expensive homes.

- Cyclone Alfred: Treasury's initial estimates show an immediate hit to Gross Domestic Product (GDP) of up to $1.2 billion due to the cyclone clean up bill. Mr Chalmers will outline Alfred's economic costs in Tuesday's speech.

- Trump's tariffs: Australia has been hit by US President Donald Trump's 25 per cent tax on all steel and aluminium imported into the US, and Mr Albanese has flagged support for the local steel and aluminium industry. In a press conference, he said "we'll provide additional support for our Buy Australian campaign which we'll be announcing as part of the budget process".

- Student debts: If re-elected, the Albanese government would reduce student debts by 20%. That package would be introduced to parliament after the election and cost the budget more than $500 million.

- Subsidised childcare: If Labor wins the election, parents will be guaranteed a minimum three days of subsidised child care regardless of how much they work or study. Families earning more than $533,280 will still not be eligible.

- $1 billion to reserve land for a future rail line linking Western Sydney Airport with south-west Sydney suburbs

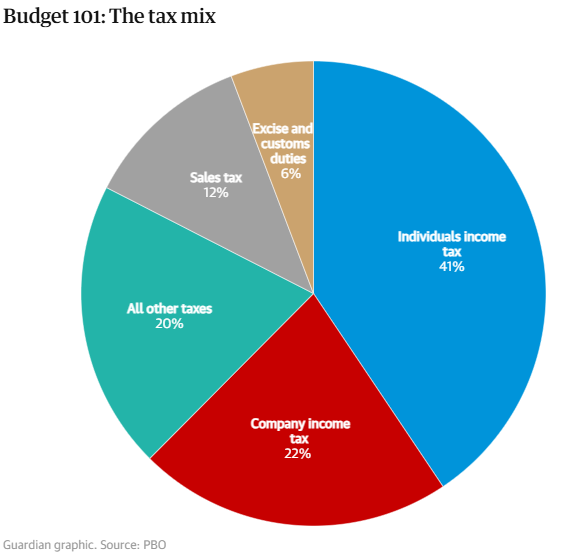

Where the money comes from

The federal government collected $650bn in taxes, excises and customs in 2022-23, and this is expected to have climbed closer to $700bn in this financial year.

The largest share of the tax collected in 2022-23 came from income tax on workers, at 40%. The next biggest single contributor is company income tax at about 20%. Sales taxes (predominately GST) account for just over 10% of commonwealth revenue.

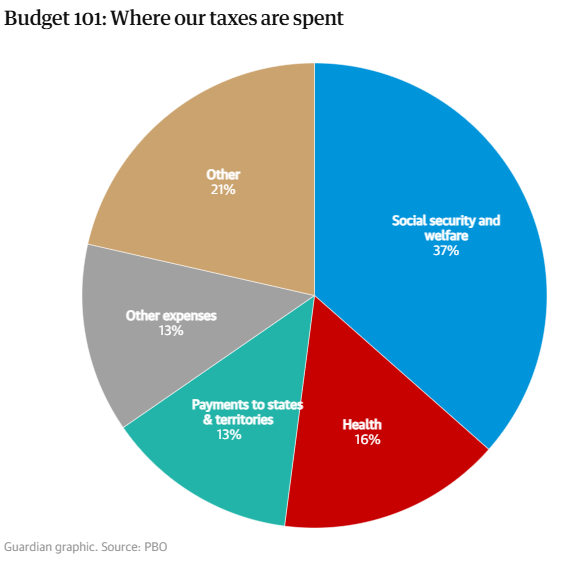

Where the money goes

Looking at estimated spending for 2023-24 in the last budget, 37% is dedicated to social security and welfare expenses. We’ll have a closer look at this area below.

Health spending is the next biggest at more than 15%, and payments to states and territories – which includes GST disbursements.

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018