How much money do we really lose in a market correction - risk mitigators in a time of panic

There is no doubt it feels uncomfortable when global share markets fall sharply in a short period of time. This is nothing new – we have lived through events like this one and come out the other side many times before over the decades. Nonetheless it doesn’t make it any easier at the time.

So, while all the focus is on how much the share market is wiping off our hard-earned savings what investments do we own that provide a positive return during this time?

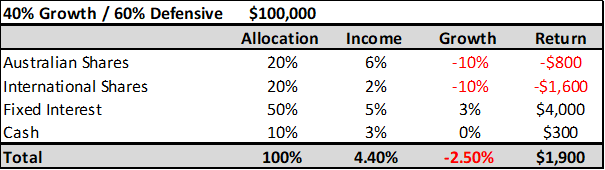

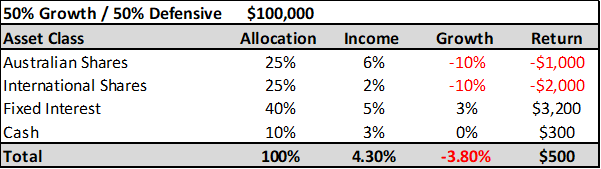

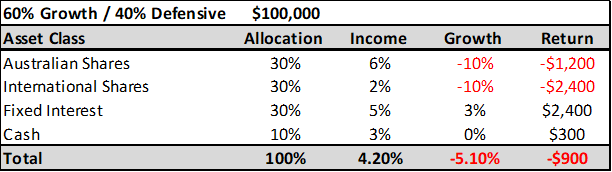

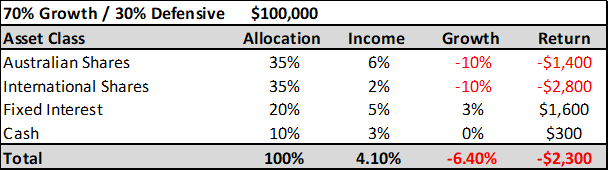

We examine what impact a -10% market correction actually has on a portfolio for 4 different risk profiles below – per $100,000 invested.

Other risk mitigation strategies to minimise / avoid losses

- Stay disciplined to your objective - don't panic and make irrational decisions by selling during a correction.

- Delay making withdrawals whereby you need to sell assets to fund it.

- Invest in quality companies, that will not be immune from a broad market sell off, however will not fall by as much.

- Pension clients - make sure you have 12 - 18 months of pension payments in cash to give you time for the volatility to pass and growth assets to recover.

- Review cash reserves with the aim of using the current volatility as an opportunity to invest in quality companies.

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018