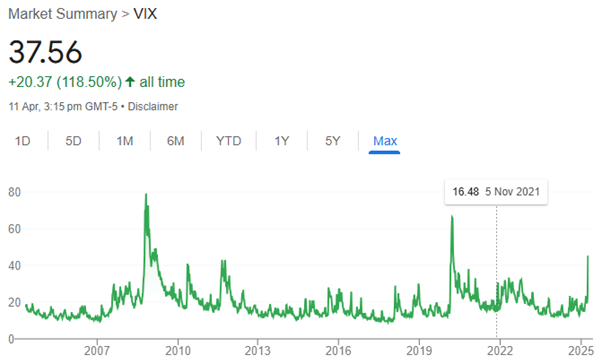

We continue to see the effects of President Trump’s historic trade policy announcements ripple through markets. The Volatility Index below highlights the magnitude of the current environment compared with the Global Financial Crisis in 2008 and the Covid crash in 2020. The latest round of tariffs and swift global responses has triggered sharp moves across equities, credit, rates, and currencies. While parts of the market have risen, some areas have moved beyond correction territory and are still in or near bear market levels.

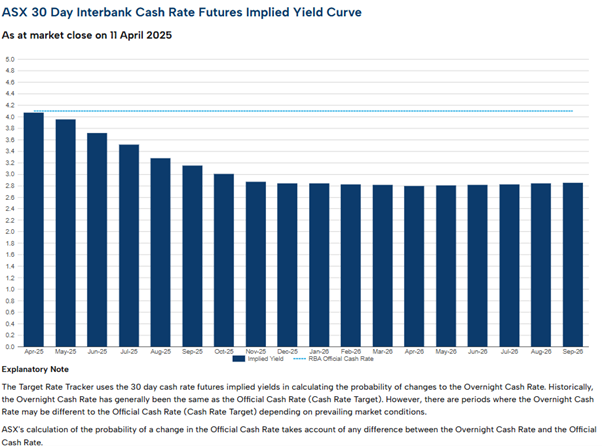

Given current conditions, many analysts have raised their recession outlook to roughly 50/50. Tariffs are contributing to higher input costs, and while the U.S. consumer remains a source of strength, it’s uncertain how long that can be sustained. Upcoming earnings guidance will offer important insight into how companies are adapting, while the path of interest rates will continue to reflect the evolving interplay between inflation and growth. The market is now pricing an 80% chance the Reserve Bank of Australia (RBA) will cut rates by 0.50% on the 19th of May and a total 1.20% by the end of the 2025, which we believe is too much.

From conversations with investment managers we engage with, a consistent message is emerging markets are policy-driven and reactive, but those dislocations are starting to reveal real opportunities. Within that framework, over the last 2 – 3 weeks we have been reviewing the following:

- Maintaining higher liquidity buffers to ensure we have flexibility to respond to market dislocations or opportunities as they arise.

- Cautiously rebalancing client portfolios that were more defensively positioned—modestly increasing equity and credit exposures back toward strategic asset allocations.

- Staying diversified across sectors, asset classes, and geographies to manage risk and preserve resilience in uncertain environments.

We are closely watching the policy path. In our view, one of the biggest risks at this stage is overreacting without fully considering the broader context. This is a good moment to reassess risk tolerance, stay grounded in your long-term strategy, and let a disciplined process guide next steps. If you have questions or want to talk through your portfolio or the current environment, please reach out

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018