Investors have reasons to be nervous about markets right now. How to separate the warning signs from the noise.

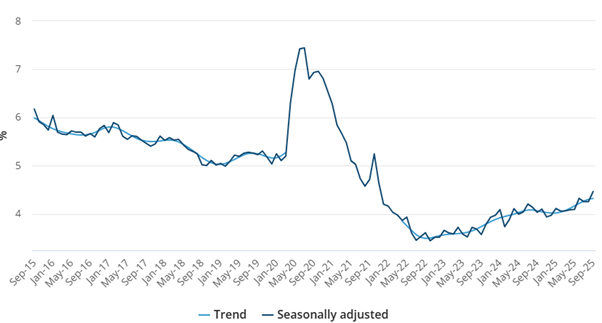

Australian unemployment hits 4-year high - interest rate cut back in play. The RBA is increasingly caught between a rock and a hard place. Inflation looks set to come in higher than the RBA’s latest forecasts, while the labour market is weaker than expected.

The RBA held rates steady at 3.60% in September, having cut three times so far this year, awaiting more inflation data. Core inflation had fallen to 2.7% in the second quarter, back in the RBA's target range of 2% to 3%, but recent monthly data pointed to a risk it had not declined further in the third quarter.

Based on the increase in the unemployment rate the market increased the probability of a rate cut from the Reserve Bank of Australia in November to 72%, from just 40% before the data.

Australian Unemployment – September 2025

The US federal government has been shut down since the start of the month and predicted it could become the longest shutdown in U.S. history.

The US Fed’s “beige book” reported that the economy has slowed down over the past two months. Last week, President Donald Trump decided to use Truth Social to announce new tariffs threats against China. And, just last week, investors got spooked by signs that banks’ recent credit losses might not be isolated incidents.

It seems as if investors have been getting hit with one market-moving risk after another — and markets have certainly moved. The VIX index closed at its highest level since April on Thursday, as U.S. stock indexes reversed between gains and losses over several choppy days of trading.

Investors who let April’s tariff drama scare them away from the stock market missed out on the 35% growth of the S&P 500 over the following six months. For those investors, that may be a hard pill to swallow.

The impressive recovery, despite all the trade headlines and other risks, underscores the importance of trading with the trend. For long-term investors, it may be better to keep a level head through the market’s ups and downs.

Copyright © 2025 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018