Is the Share market cheap or expensive — Equities Valuation Snapshot

Australian Share Market (ASX) — Valuations Elevated

Current Valuation Summary

- The Australian equity market, as measured by broad indices like the S&P/ASX 200, is trading on above-average valuation multiples compared with historical norms. Forward price-to-earnings ratios in the low-to-mid 20s are well above long-term averages (often mid-teens historically), indicating a relatively expensive market by traditional valuation measures.

Context & Market Signals

- Elevated P/E multiples suggest investors are paying premium prices for future earnings compared with long-run history.

- Some institutional indicators flagged overvaluation, historically associated with cautionary levels.

- While certain segments or stocks within the ASX may offer value, the market as a whole is not broadly “cheap” at current prices.

Strategic Thought (Australia):

- Traditional valuation signals suggest that future expected returns may be subdued compared to periods of lower valuation, although strong earnings growth can still support positive performance.

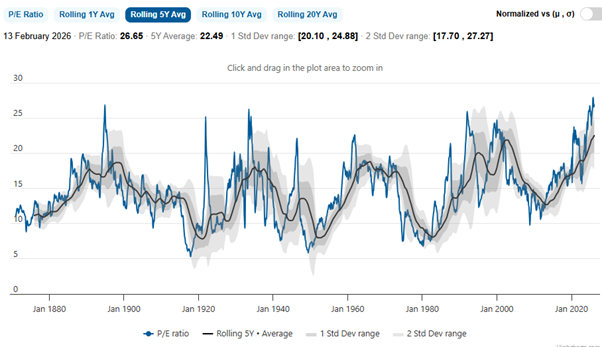

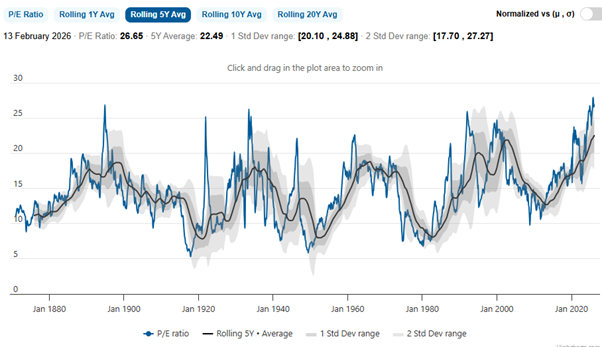

U.S. Share Market — High But Better Anchored by Growth

Valuation Overview

- The U.S. equity market — measured by the S&P 500 — also sits at historically high valuation levels. Forward P/E multiples are in the low-to-mid 20s, above long-term averages, though slightly lower than peaks seen in recent years.

- Analysts note U.S. valuations look expensive relative to history and may remain elevated if corporate earnings continue to grow.

Growth and Breadth Considerations

- Importantly, U.S. markets tend to trade at higher multiples partly due to stronger expected earnings growth, particularly from technology and large-cap companies.

- Recent market dynamics have also shown volatility and sector rotation, with some traditional high-growth segments correcting while other industries contribute to performance.

Strategic Thought (U.S.):

- Although valuations are high, they may be less detached from fundamentals than in Australia, supported by stronger earnings growth expectations and broader economic drivers.

- Investors should remain mindful that long-run return expectations from high starting valuations tend to be lower, even if absolute returns can still be positive.

Implications for Strategic Positioning

- Long-Term Investors

- Elevated valuations suggest that future return assumptions should be tempered. Higher starting multiples often correlate with lower expected long-term returns.

- Consider diversifying beyond domestic equities, with attention to areas offering better valuations or diversified growth profiles.

- Tactical Adjustments

- Maintain discipline in entry points — resist chasing recent highs, particularly in segments lacking valuation support.

- Use market pullbacks or volatility to rebalance and add exposure selectively.

- Sector & Style Considerations

- In Australia, avoid broad market bets based solely on index performance — focus on fundamentals and valuation discipline.

- In the U.S., investors may align exposures with sectors where earnings growth prospects and valuations still present a reasonable risk/reward.

Final Takeaway

At present, neither the Australian nor U.S. share markets can be classified as “cheap” by traditional valuation metrics. Both trade at historically elevated levels, though the drivers differ. Australia’s market looks expensive with more modest growth expectations priced in, while the U.S. market’s high valuation is partially justified by stronger earnings growth prospects.

For investors, this valuation backdrop suggests caution, valuations-driven discipline, and selective positioning remain prudent as markets enter 2026.

Copyright © 2026 Coastline Private Wealth, All rights reserved.

Our mailing address is:

PO Box 2082

Churchlands WA 6018